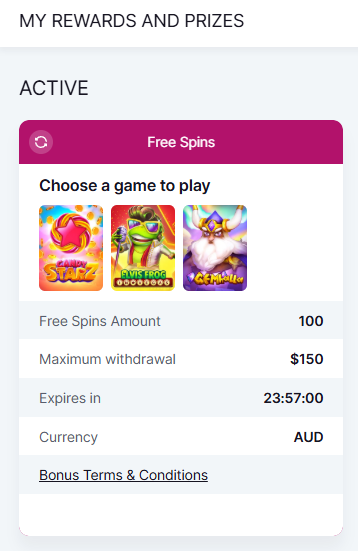

Professional illustration about XRP

Binance in 2025 Overview

Binance in 2025 Overview

As the world’s largest crypto exchange, Binance continues to dominate the crypto market in 2025, despite facing intense scrutiny from regulators worldwide. Under the leadership of Richard Teng, who took over after Changpeng Zhao (CZ) stepped down following the DOJ settlement, the platform has doubled down on regulatory compliance while expanding its ecosystem. Binance.US, its American counterpart, has navigated the SEC lawsuit and CFTC investigation by implementing stricter identity verification protocols and adopting a more transparent approach to crypto trading.

One of the biggest shifts in 2025 is Binance’s focus on decentralized finance (DeFi), with its native token BNB playing a central role in powering transactions across its blockchain. The exchange has also deepened its integration with major digital assets like Bitcoin, Ethereum, and SOL, while supporting emerging tokens such as ADA, DOGE, XRP, and OP. The platform’s ability to adapt to crypto regulations has been critical, especially after high-profile cases involving financial crimes and market manipulation in previous years.

Political and celebrity endorsements have further shaped Binance’s trajectory. Figures like Elon Musk and Donald Trump have publicly discussed cryptocurrencies, indirectly influencing trading volumes on Binance. Meanwhile, Yi He, co-founder of Binance, has been instrumental in steering the platform’s strategic partnerships, particularly in regions with growing crypto market adoption.

However, challenges remain. The shadow of past crypto scams and ongoing legal battles means Binance must continuously prove its commitment to security and transparency. In 2025, the exchange has introduced AI-driven fraud detection systems and enhanced user education to combat financial crimes. Additionally, its collaboration with regulators to establish clearer crypto regulations has helped restore trust among institutional investors.

For traders, Binance remains the go-to platform for its liquidity, low fees, and extensive altcoin offerings. The rise of decentralized finance has also led Binance to integrate more DeFi protocols, allowing users to stake BNB and other tokens directly on the exchange. With Bitcoin and Ethereum still leading the market, Binance’s futures and spot trading options provide unparalleled flexibility for both retail and professional traders.

Looking ahead, Binance’s ability to balance innovation with compliance will determine its long-term success. The crypto exchange is no longer just a trading platform—it’s a cornerstone of the global blockchain ecosystem, shaping how digital assets are bought, sold, and utilized in everyday finance. Whether you’re trading DOGE for fun or diversifying with SOL and ADA, Binance in 2025 offers tools and security measures that cater to every level of investor.

Binance Trading Fees Explained

Binance Trading Fees Explained

Understanding Binance’s trading fee structure is crucial for both new and experienced crypto traders. As of 2025, Binance remains one of the most cost-effective platforms for trading Bitcoin (BTC), Ethereum (ETH), and altcoins like ADA, DOGE, XRP, SOL, and OP. The exchange uses a maker-taker model, where fees range from 0.1% to 0.02% depending on your 30-day trading volume and whether you’re a maker (adding liquidity) or taker (removing liquidity). For example, a high-volume trader with over $50M in monthly volume pays just 0.02% as a maker fee, while a casual trader might pay the standard 0.1%.

One of the biggest perks? BNB (Binance Coin) discounts. If you hold BNB and use it to pay fees, you get an automatic 25% reduction—dropping the standard 0.1% fee to 0.075%. This incentive has made BNB a favorite among frequent traders, especially since the token’s utility extends beyond just fee discounts (think staking, DeFi integrations, and more). However, keep in mind that Binance.US, the platform’s American arm, has slightly different fee structures due to stricter crypto regulations and compliance with agencies like the SEC and CFTC.

Recent changes under CEO Richard Teng (who took over after Changpeng Zhao’s 2023 DOJ settlement) include tighter identity verification processes and adjustments to fee tiers to align with global regulatory compliance standards. For instance, Binance now enforces stricter KYC (Know Your Customer) rules, which can impact fee discounts for unverified users. Additionally, the exchange has introduced zero-fee trading promotions for specific pairs—like BTC/FDUSD or ETH/USDC—to attract liquidity during volatile crypto market conditions.

Here’s a pro tip: If you’re trading large amounts, consider Binance’s VIP program, which offers progressively lower fees based on your BNB holdings and trading activity. VIP tiers start at Level 1 (0.09% taker fee) and go up to Level 9 (0.02% taker fee). For context, a trader with 10,000 BNB and $5M in monthly volume qualifies for VIP Level 3, slashing fees by nearly 50% compared to the standard rate.

Be wary of hidden costs, though. While spot trading fees are transparent, other services like instant buy/sell (via credit card) or margin trading can carry higher charges—sometimes up to 0.5%. Also, withdrawals aren’t free; transferring Bitcoin off Binance costs a network fee that fluctuates with blockchain congestion.

Finally, with the SEC lawsuit and ongoing CFTC investigations shaping Binance’s policies, traders should stay updated on fee adjustments. For example, the exchange recently waived fees for XRP trades following Ripple’s legal victory against the SEC, showcasing how crypto regulations directly impact pricing. Whether you’re a Dogecoin enthusiast inspired by Elon Musk’s tweets or a DeFi degens chasing the next SOL or OP gem, mastering Binance’s fee system can save you thousands annually.

Binance Security Features 2025

Binance Security Features 2025: How the World’s Top Crypto Exchange Keeps Your Assets Safe

In 2025, Binance continues to lead the crypto exchange industry with cutting-edge security measures designed to protect users’ digital assets from crypto scams, financial crimes, and market manipulation. Under the leadership of Richard Teng, who succeeded Changpeng Zhao in late 2023, Binance has doubled down on regulatory compliance and transparency, especially after the DOJ settlement and ongoing SEC lawsuit. Here’s a breakdown of the platform’s most critical security features this year:

Binance’s identity verification process is now stricter than ever, requiring multi-tiered authentication for all users, including those on Binance.US. The platform uses AI-powered facial recognition and document scanning to prevent fake accounts, aligning with global crypto regulations. Even high-profile figures like Elon Musk or Donald Trump (if they traded crypto) would need to complete these steps—no exceptions.

Originally launched in 2018, the SAFU fund has been upgraded in 2025 to cover 100% of user deposits in case of breaches. This self-insurance pool, funded by 10% of Binance’s trading fees, now holds a diversified portfolio including Bitcoin, Ethereum, BNB, and stablecoins. The fund’s transparency is audited quarterly, a move that reassures traders amid CFTC investigations and regulatory scrutiny.

Binance’s proprietary AI system, developed with input from Yi He (co-founder and head of Binance Labs), monitors transactions in real-time for suspicious activity. For example, if a user suddenly dumps millions in DOGE or ADA, the system flags potential market manipulation. The AI also detects phishing attempts and fake customer support scams—common threats in decentralized finance (DeFi).

Over 95% of Binance’s crypto trading assets are stored in cold storage (offline wallets), with multi-signature technology requiring approval from multiple executives to access funds. This makes hacking nearly impossible, even for large-cap tokens like XRP or SOL. Hot wallets (used for daily transactions) are insured by third-party providers, adding another layer of protection.

Post-2023, Binance has worked closely with global regulators to standardize security practices. For instance, the exchange now complies with the Travel Rule, sharing transaction details for transfers over $1,000 to combat money laundering. This proactive approach has helped Binance navigate the crypto market’s evolving legal landscape, though critics argue it clashes with crypto’s privacy ethos.

Binance’s security blog and YouTube channel regularly update users on emerging threats, like fake OP token airdrops or impersonators of Changpeng Zhao on social media. The platform also encourages hardware wallet integration for high-net-worth traders, reducing exposure to exchange-based risks.

Beyond centralized measures, Binance has invested in blockchain-native solutions, such as smart contract audits for BNB Chain projects and partnerships with DeFi platforms to vet code vulnerabilities. This is critical as exploits in decentralized finance protocols remain a top industry concern.

In summary, Binance’s 2025 security framework combines institutional-grade safeguards with user-centric tools, setting a benchmark for the crypto market. Whether you’re trading Bitcoin or memecoins like DOGE, these features ensure your assets stay protected—even in a volatile regulatory climate.

Binance Mobile App Review

Binance Mobile App Review: A Powerhouse for Crypto Trading in 2025

The Binance mobile app remains one of the most dominant platforms for crypto trading in 2025, offering a seamless experience for both beginners and advanced traders. Whether you're trading Bitcoin, Ethereum, or altcoins like ADA, DOGE, XRP, SOL, or OP, the app provides real-time market data, advanced charting tools, and lightning-fast execution. Under the leadership of Richard Teng (who succeeded Changpeng Zhao after the DOJ settlement), Binance has doubled down on regulatory compliance, making identity verification smoother while maintaining robust security measures.

Why the Binance App Stands Out

- User-Friendly Interface: The app’s intuitive design makes it easy to navigate between spot trading, futures, and decentralized finance (DeFi) options. Even newcomers can quickly buy BNB or swap tokens with minimal friction.

- Advanced Features: Pro traders will appreciate the depth of tools, including customizable candlestick charts, limit orders, and API integrations. The app also supports staking for passive income, a feature that’s grown in popularity amid the 2025 crypto market surge.

- Security Enhancements: After the SEC lawsuit and CFTC investigation, Binance has implemented stricter safeguards against financial crimes and market manipulation. Biometric login and multi-factor authentication (MFA) are now standard.

Challenges and Considerations

While the app excels in functionality, some users report occasional delays during peak crypto exchange volatility. Additionally, Binance.US operates under tighter restrictions due to evolving crypto regulations, limiting certain features compared to the global platform. High-profile figures like Elon Musk and Donald Trump have influenced market sentiment around assets like DOGE, but Binance’s app ensures traders can react swiftly to such trends.

Final Verdict

For those deeply embedded in the blockchain ecosystem, the Binance mobile app is a must-have. Its blend of accessibility, security, and innovation keeps it ahead of competitors—though users should stay vigilant against crypto scams and always enable all available security features. Whether you're a casual investor or a seasoned trader, this app delivers the tools needed to navigate the fast-paced world of digital assets.

Binance Staking Rewards

Binance Staking Rewards: How to Earn Passive Income in 2025

Staking has become one of the most popular ways to earn passive income in the crypto market, and Binance continues to lead the pack with competitive rewards. Whether you're holding BNB, Bitcoin, Ethereum, or altcoins like ADA, DOGE, XRP, SOL, or OP, Binance offers flexible staking options with varying APYs. Under the leadership of Richard Teng (who succeeded Changpeng Zhao in late 2024), Binance has maintained its focus on regulatory compliance while expanding staking opportunities.

How Binance Staking Works

Binance allows users to lock their digital assets for a fixed or flexible term, earning rewards based on the blockchain network's consensus mechanism. For example, staking BNB on Binance can yield up to 8% APY, while Ethereum staking (post-Merge) offers around 5-6%. The platform also supports decentralized finance (DeFi) projects, enabling users to stake newer tokens like OP with higher short-term yields.

Key Factors to Consider in 2025

- Regulatory Landscape: Following the SEC lawsuit and DOJ settlement, Binance has tightened its identity verification processes. U.S. users must now rely on Binance.US, which offers limited staking options due to crypto regulations.

- Market Risks: While staking is generally low-risk compared to crypto trading, rewards fluctuate based on network demand. For instance, SOL staking APYs dropped slightly in early 2025 after a surge in validator participation.

- Lock-Up Periods: Flexible staking lets you withdraw anytime (with lower rewards), while fixed terms (e.g., 30-90 days) offer higher yields but require commitment.

Maximizing Your Staking Strategy

Diversification is key. Instead of staking only Bitcoin, consider splitting your portfolio between high-cap assets like Ethereum and mid-cap gems like ADA. Binance also offers auto-staking for select tokens, compounding rewards automatically—ideal for long-term holders. Keep an eye on crypto scams; always stake directly through Binance’s official platform, not third-party sites promising unrealistic returns.

The Future of Binance Staking

With crypto market maturity in 2025, Binance is expected to integrate more regulatory-compliant staking products. Rumors suggest partnerships with traditional finance institutions could introduce hybrid staking models. Meanwhile, high-profile endorsements from figures like Elon Musk and Donald Trump continue to drive mainstream adoption, indirectly boosting staking participation.

For those new to staking, start small with flexible terms to test the waters. As the financial crimes crackdown intensifies, Binance’s emphasis on transparency makes it a safer choice than unregulated exchanges. Whether you're a casual investor or a crypto trading veteran, staking on Binance remains a smart way to grow your holdings passively.

Binance NFT Marketplace Guide

The Binance NFT Marketplace has become one of the most prominent platforms for trading digital collectibles, offering a seamless blend of blockchain technology and crypto trading. Whether you're a seasoned collector or a newcomer, understanding how to navigate this marketplace is crucial, especially in 2025, as the platform continues to evolve under the leadership of Richard Teng, who took over after Changpeng Zhao stepped down. The marketplace supports a wide range of digital assets, including Bitcoin-backed NFTs, Ethereum-based collections, and even tokens like ADA, DOGE, XRP, SOL, and OP. One of the standout features is its integration with BNB, Binance's native token, which often provides users with discounted fees and exclusive access to high-profile drops.

For Binance.US users, the experience is slightly different due to regulatory constraints, but the core functionality remains robust. The platform emphasizes regulatory compliance, requiring thorough identity verification to combat financial crimes and market manipulation. This is particularly important given the SEC lawsuit and DOJ settlement that Binance faced in recent years, which have shaped its current policies. The marketplace also leverages decentralized finance (DeFi) principles, allowing users to mint, buy, and sell NFTs without intermediaries.

Here’s how to get the most out of the Binance NFT Marketplace in 2025:

- Explore Trending Collections: The homepage highlights trending NFTs, often tied to major crypto events or collaborations with figures like Elon Musk or Donald Trump (who have both dabbled in NFT projects). Keep an eye on limited-edition drops, as they tend to appreciate in value.

- Use BNB for Discounts: Paying with BNB can save you up to 25% on transaction fees, making it a smart choice for frequent traders.

- Leverage Gas-Free Minting: Unlike Ethereum-based platforms, Binance offers gas-free minting for select collections, reducing upfront costs.

- Stay Informed on Regulations: With ongoing CFTC investigations and shifting crypto regulations, it’s wise to follow Binance’s official updates to avoid potential pitfalls.

- Avoid Scams: The marketplace has safeguards, but crypto scams still exist. Always verify the authenticity of NFTs and sellers before purchasing.

The crypto market in 2025 is more competitive than ever, and Binance’s NFT platform stands out by combining user-friendly features with deep liquidity. Whether you're trading Bitcoin-themed art or Ethereum-powered gaming assets, the key is to stay strategic—diversify your portfolio, monitor market trends, and capitalize on decentralized finance opportunities. With Yi He overseeing Binance’s ecosystem growth, the NFT marketplace is poised to remain a leader in the space, despite regulatory challenges. Just remember: in the fast-moving world of digital assets, due diligence is your best defense against volatility and fraud.

Binance Crypto Loans 2025

Binance Crypto Loans 2025: A Flexible Way to Access Liquidity Without Selling Your Assets

In 2025, Binance Crypto Loans remains one of the most popular ways for traders and long-term holders to unlock liquidity without parting with their Bitcoin, Ethereum, or other digital assets. Whether you're a BNB staker, a DeFi enthusiast, or just need short-term capital, Binance’s loan platform offers competitive interest rates and a streamlined process. Under the leadership of Richard Teng, who took over after Changpeng Zhao stepped down, Binance has doubled down on regulatory compliance, ensuring that its loan products meet global standards despite ongoing SEC lawsuits and CFTC investigations.

How Binance Crypto Loans Work in 2025

The process is simple: you deposit crypto collateral (like BTC, ETH, ADA, or SOL) and borrow stablecoins or other supported assets. Loan terms are flexible, ranging from 7 to 180 days, with interest rates as low as 4.5% APR for BNB holders. For example, if you lock up 1 Bitcoin as collateral, you could borrow up to 70% of its value in USDT or BUSD—perfect for leveraging market opportunities without triggering taxable events.

Why Use Binance Loans Instead of Traditional Financing?

- No credit checks: Unlike banks, Binance only requires identity verification and collateral, making loans accessible even for those with limited credit history.

- Instant approvals: Funds are disbursed within minutes, a game-changer for traders needing quick liquidity during crypto market volatility.

- Multi-collateral options: Beyond Bitcoin and Ethereum, you can use XRP, DOGE, or even OP as collateral, though loan-to-value (LTV) ratios vary by asset.

Risks and Regulatory Considerations

While convenient, Binance Crypto Loans aren’t risk-free. The SEC lawsuit and DOJ settlement in 2024 highlighted concerns over market manipulation and financial crimes, prompting stricter crypto regulations. Users should monitor collateral levels closely—if your BTC drops below the maintenance threshold, Binance may liquidate your position automatically. Additionally, Yi He, Binance’s co-founder, has emphasized the platform’s focus on combating crypto scams, but borrowers should still exercise caution.

Elon Musk and Donald Trump’s Influence on Crypto Loans

The 2025 political and tech landscape plays a role too. Elon Musk’s tweets about DOGE or Donald Trump’s pro-crypto policies could trigger price swings, affecting collateral values. Savvy borrowers keep an eye on macroeconomic trends and adjust their LTV ratios accordingly.

Final Tips for Maximizing Binance Crypto Loans

- Diversify collateral: Don’t rely solely on volatile assets like DOGE; mix in stablecoins or BNB to reduce liquidation risks.

- Use loans strategically: Whether for DeFi yield farming or hedging, have a clear repayment plan.

- Stay updated: With crypto trading regulations evolving, follow Binance’s announcements to avoid surprises.

In 2025, Binance Crypto Loans continue to bridge the gap between decentralized finance and traditional liquidity needs—but always borrow responsibly.

Binance Futures Trading Tips

Binance Futures Trading Tips for 2025: Maximizing Profits While Managing Risks

Trading futures on Binance can be highly lucrative, but it requires a strategic approach—especially in 2025’s volatile crypto market. Whether you’re trading Bitcoin, Ethereum, or altcoins like ADA, DOGE, or SOL, these tips will help you navigate Binance Futures with confidence.

1. Master Leverage Wisely

Binance offers leverage up to 125x, but higher leverage isn’t always better. While it amplifies gains, it also increases liquidation risks. For beginners, sticking to 5x–10x leverage on stable assets like Bitcoin or Ethereum is safer. For example, a 10x long on BNB during a bullish trend (like post-DOJ settlement rallies) can yield solid returns without excessive risk. Always set stop-loss orders to protect your capital—market manipulation and sudden regulatory news (think SEC lawsuits or CFTC investigations) can trigger sharp reversals.

2. Stay Updated on Regulatory Shifts

Under Richard Teng’s leadership, Binance has prioritized regulatory compliance, but the landscape remains unpredictable. Follow updates on crypto regulations, especially in the U.S. (Binance.US operates under stricter rules). For instance, the 2025 SEC lawsuit resolution could impact XRP or SOL futures liquidity. Traders should also complete identity verification (KYC) promptly to avoid account restrictions.

3. Diversify Across Crypto Assets

Don’t put all your funds into one coin. Spread exposure across high-cap assets (Bitcoin, Ethereum) and promising alts like OP or ADA. For example, during Elon Musk’s 2025 DOGE tweets, futures traders who balanced positions with BNB (Binance’s native token) mitigated volatility risks. Use Binance’s multi-asset margin mode to collateralize trades with stablecoins or digital assets like XRP.

4. Track Liquidation Levels and Funding Rates

Binance’s futures dashboard displays liquidation heatmaps—use them to spot crowded trades. If most traders are long Bitcoin at $70K, a slight dip could trigger cascading liquidations. Also, monitor funding rates: Positive rates mean longs pay shorts (common in bull markets), while negative rates suggest bearish sentiment. Adjust positions accordingly to avoid paying excessive fees.

5. Combine Technical and Fundamental Analysis

Technical indicators (e.g., RSI, MACD) are vital, but 2025’s crypto trading landscape demands fundamental analysis too. Watch for:

- Changpeng Zhao or Yi He’s statements about Binance’s decentralized finance initiatives.

- Donald Trump’s crypto policies (if re-elected), which could sway crypto market sentiment.

- Blockchain upgrades (e.g., Ethereum’s Dencun hard fork) that may impact futures pricing.

6. Avoid Common Crypto Scams

Scams like fake Binance support teams or phishing sites persist. Never share API keys or 2FA codes. Also, beware of “pump-and-dump” schemes—especially with low-cap coins promoted by influencers. Stick to Binance’s verified futures pairs to reduce exposure to financial crimes.

7. Use Binance’s Risk-Management Tools

Enable features like:

- Take-Profit/Take-Loss (TP/SL): Automate exits at predefined levels.

- Trailing Stop: Lock in profits during rallies (e.g., if SOL surges 20%).

- Isolated Margin: Limit losses to specific positions instead of entire accounts.

8. Adapt to Market Cycles

In 2025, crypto trading cycles may shorten due to institutional adoption. During bull runs, focus on long positions with Bitcoin or Ethereum futures. In bear markets, shorting overhyped alts (like DOGE after a Musk tweet) can be profitable—but always hedge with stablecoin holdings.

Final Pro Tip: Join Binance’s futures trading competitions (often promoted by Yi He) to test strategies with low risk. Analyze past winners’ tactics, such as scalping XRP during high volatility or swing-trading OP around layer-2 news. Remember, discipline and continuous learning are key to surviving—and thriving—in Binance Futures.

Binance Spot Trading Strategies

Binance Spot Trading Strategies for 2025: Maximizing Profits in a Regulated Market

Spot trading on Binance remains one of the most accessible ways to capitalize on crypto market movements, especially with major assets like Bitcoin (BTC), Ethereum (ETH), and altcoins such as ADA, DOGE, XRP, SOL, and OP. Unlike futures trading, spot trading involves buying and selling digital assets directly, making it ideal for traders who prefer lower risk and straightforward execution. In 2025, with Binance navigating post-DOJ settlement challenges and stricter crypto regulations, traders need refined strategies to stay ahead.

1. Dollar-Cost Averaging (DCA) for Long-Term Holders

DCA is a proven strategy for mitigating volatility, especially with blue-chip cryptos like BTC and ETH. For example, splitting a $1,000 monthly investment into weekly buys on Binance.US or global Binance platforms smooths out price fluctuations. This approach is particularly useful amid SEC lawsuits or CFTC investigations, where sudden regulatory news can trigger market swings. Pair DCA with BNB staking to earn passive income while holding your positions.

2. Swing Trading with Technical Analysis

Swing traders capitalize on short-to-medium-term price movements. Tools like Binance’s TradingView integration help identify trends in assets like SOL or OP. Key indicators to watch:

- Relative Strength Index (RSI): Overbought (>70) or oversold (<30) signals.

- Moving Averages: Golden cross (50-day MA crossing above 200-day MA) for bullish trends.

- Support/Resistance Levels: Critical for timing entries/exits, e.g., XRP’s $0.50 support in Q1 2025.

3. News-Based Trading (But Stay Cautious)

Crypto markets react sharply to headlines—Elon Musk tweeting about DOGE or Donald Trump commenting on crypto regulations can move prices. However, post-DOJ settlement, Binance has tightened identity verification to curb market manipulation. Always verify news sources and avoid FOMO-driven trades. For instance, rumors about Changpeng Zhao or Richard Teng stepping down could cause temporary dips, but fundamentals matter more long-term.

4. Arbitrage Opportunities Across Pairs

Price discrepancies between Binance and other exchanges (or between BNB pairs) still exist, though they’ve narrowed due to improved liquidity. Monitor low-cap altcoins like ADA or OP for fleeting arbitrage windows. Note: Withdrawal fees and regulatory compliance delays can eat into profits, so calculate net gains carefully.

5. Portfolio Diversification and Risk Management

Avoid overexposure to a single asset. A balanced 2025 portfolio might include:

- 40% BTC/ETH (store of value).

- 30% high-potential alts (SOL, XRP).

- 20% staked BNB (for fee discounts and rewards).

- 10% speculative plays (DOGE, meme coins).

Use Binance’s stop-loss and take-profit orders to automate exits. For example, set a 10% stop-loss on SOL if the crypto market shows bearish signals.

Final Tactical Notes for 2025

- Regulatory Awareness: Follow updates on SEC lawsuits and global crypto regulations—these impact liquidity and token availability.

- Avoid Scams: Post-DOJ settlement, Binance has cracked down on crypto scams, but always double-check contract addresses for tokens like OP or ADA.

- Leverage Binance Tools: Use their Spot Grid Bots for automated trading or Savings products to earn yield on idle assets.

By combining these strategies, traders can navigate Binance’s evolving landscape while leveraging blockchain innovations and decentralized finance (DeFi) integrations. Whether you’re a beginner or a pro, adaptability is key in 2025’s regulated yet dynamic crypto environment.

Binance Customer Support

Binance Customer Support: Navigating Challenges in 2025

In 2025, Binance remains one of the largest crypto exchanges globally, but its customer support system has faced scrutiny amid regulatory pressures and growing user demands. With the SEC lawsuit, DOJ settlement, and CFTC investigation reshaping the platform’s operations, users often report mixed experiences with Binance’s support team. While some praise its 24/7 live chat for quick resolutions, others highlight delays during high-volume periods, especially for identity verification or withdrawal issues.

For Binance.US users, the landscape is even more complex due to stricter crypto regulations in the U.S. The platform has streamlined its regulatory compliance processes, but this sometimes translates to longer wait times for support tickets. A common pain point? Crypto scams and phishing attempts targeting Bitcoin, Ethereum, and BNB traders. Binance’s team has rolled out AI-driven fraud detection tools, yet users must stay vigilant—double-checking official channels like the Binance Help Center or verified social media accounts (not impersonators citing Elon Musk or Donald Trump endorsements).

Here’s how to maximize Binance’s support resources in 2025:

- Use the Binance Help Center first: Many issues (e.g., ADA staking errors or XRP deposit delays) are resolved via step-by-step guides.

- Leverage the chatbot for tier-1 issues: Simple tasks like resetting 2FA or unlocking crypto trading restrictions often get instant fixes.

- Escalate strategically: For complex problems (e.g., market manipulation disputes or DOGE withdrawal freezes), submit a ticket with transaction IDs and screenshots—then follow up via Twitter/X (@BinanceHelp).

Leadership changes, including Richard Teng taking over from Changpeng Zhao, have also influenced support priorities. The new focus on decentralized finance (DeFi) integrations and SOL/OP chain support has strained resources, but Binance is investing in training agents to handle blockchain-specific queries. Pro tip: Traders dealing with financial crimes allegations (e.g., accidental receipt of illicit funds) should request direct email support with the compliance team—avoiding public forums.

Despite hurdles, Binance’s multilingual support (covering 15+ languages) and expanding knowledge base make it a standout among competitors. However, as crypto market volatility persists, users should document all interactions and avoid sharing sensitive data—even with seemingly legitimate “support” accounts. The key? Patience and persistence, as Binance’s team adapts to 2025’s evolving digital assets landscape.

Binance KYC Process 2025

The Binance KYC Process in 2025: What You Need to Know

As regulatory scrutiny intensifies in the crypto space, Binance's Know Your Customer (KYC) protocols have evolved significantly in 2025. Whether you're trading Bitcoin, Ethereum, or altcoins like ADA, DOGE, or SOL, completing KYC is now mandatory for all users on Binance and Binance.US. The exchange, led by CEO Richard Teng (who succeeded Changpeng Zhao after the DOJ settlement), has tightened compliance to align with global crypto regulations. Here's a breakdown of the current process and why it matters for your crypto trading experience.

Why Binance KYC Matters More Than Ever

Following the SEC lawsuit and CFTC investigation, Binance has doubled down on identity verification to combat financial crimes like market manipulation and crypto scams. In 2025, unverified users face severe restrictions—you can't deposit, withdraw, or trade digital assets without completing KYC. This shift reflects broader trends in decentralized finance, where exchanges are prioritizing regulatory compliance to avoid legal backlash. Even high-profile figures like Elon Musk and Donald Trump (who've publicly engaged with crypto) would need to submit their IDs to trade on Binance today.

Step-by-Step: How to Complete Binance KYC in 2025

- Account Setup: Start by signing up with an email/phone number. Binance no longer allows anonymous accounts, unlike its early days under Yi He's leadership.

- Basic Verification: Upload a government-issued ID (passport, driver’s license) and a selfie. The system uses AI to detect fraud, so ensure your documents are clear and unedited.

- Address Proof: Submit a utility bill or bank statement dated within the last 3 months. This step is critical for users in regions with strict crypto exchange laws.

- Advanced Verification (For High-Volume Traders): If you’re moving large sums (e.g., trading BNB or XRP), expect a video call with a compliance officer. This extra layer targets market manipulation risks.

Common Pitfalls and How to Avoid Them

- Blurry Documents: Rejections often happen due to poor-quality uploads. Use a high-resolution camera and avoid glare.

- Mismatched Details: Ensure your name on Binance matches your ID exactly. Even a middle initial discrepancy can delay approval.

- Geographic Restrictions: Some blockchain assets (like OP) may require additional checks depending on your country. Check Binance’s updated list of supported regions.

The Bigger Picture: KYC and Crypto’s Future

While purists argue that KYC contradicts decentralized finance ideals, Binance’s 2025 approach reflects unavoidable industry realities. The DOJ settlement forced the exchange to adopt stricter policies, and rivals are following suit. For traders, this means slower onboarding but safer crypto market participation. Whether you’re a Bitcoin maximalist or a DOGE enthusiast, understanding these rules is key to uninterrupted trading in today’s regulated landscape.

Binance DeFi Integration

Binance DeFi Integration: The Future of Decentralized Finance on the World’s Largest Crypto Exchange

Binance has been aggressively expanding its DeFi (Decentralized Finance) offerings, positioning itself as a bridge between centralized and decentralized crypto trading. With Changpeng Zhao stepping down in late 2023 and Richard Teng taking over as CEO, the exchange has doubled down on compliance while pushing innovative DeFi integrations. In 2025, Binance users can now seamlessly swap between Bitcoin, Ethereum, and popular altcoins like ADA, DOGE, XRP, SOL, and OP directly through its DeFi wallet, eliminating the need for third-party platforms. This move not only simplifies crypto trading but also strengthens BNB’s utility within the Binance ecosystem.

One of the standout features is Binance’s cross-chain DeFi hub, which allows users to stake, lend, and borrow digital assets across multiple blockchains. For example, you can stake BNB on Binance Chain while simultaneously providing liquidity for an Ethereum-based DeFi protocol—all without leaving the platform. This integration addresses a major pain point in decentralized finance: fragmentation. By consolidating these services, Binance reduces the risk of crypto scams and market manipulation, which have plagued standalone DeFi platforms.

However, Binance’s DeFi push hasn’t been without challenges. The SEC lawsuit and DOJ settlement in 2024 forced the exchange to tighten regulatory compliance, including stricter identity verification processes. While some users criticized these measures as antithetical to DeFi’s permissionless ethos, others argue that Binance’s hybrid model—combining centralized security with decentralized functionality—is the only viable path for mass adoption. Yi He, Binance’s co-founder, has emphasized that "DeFi shouldn’t mean no rules; it should mean better rules."

Politically, the crypto landscape remains volatile. Figures like Elon Musk and Donald Trump have swayed public opinion on digital assets, with Musk’s tweets still causing DOGE price swings and Trump’s pro-crypto stance influencing U.S. regulations. Binance has navigated this turbulence by partnering with regulators to shape crypto regulations while advocating for clearer guidelines. The CFTC investigation into decentralized exchanges in early 2025 further highlighted the need for balanced oversight—a challenge Binance is tackling head-on with its compliant DeFi framework.

For traders, Binance’s DeFi integration offers tangible benefits:

- Lower fees: Swapping BNB for SOL or OP incurs minimal gas fees compared to standalone DeFi protocols.

- Enhanced security: Binance’s audit systems reduce exposure to financial crimes like rug pulls.

- Simplified UX: Newcomers can dip into DeFi without grappling with complex wallet setups or bridging assets.

Looking ahead, Binance’s DeFi strategy will likely focus on interoperability. Imagine borrowing Bitcoin against your Ethereum holdings or using XRP as collateral in a Binance.US-compliant loan—all executed trustlessly via smart contracts. As the crypto market matures, Binance’s ability to merge centralized efficiency with decentralized innovation could redefine how we interact with blockchain technology.

Binance New Listings 2025

Binance New Listings 2025

The crypto market in 2025 continues to evolve, and Binance, under the leadership of Richard Teng, remains at the forefront of crypto trading with its highly anticipated new listings. As the world’s largest crypto exchange, Binance has consistently introduced innovative digital assets, and 2025 is no exception. This year, the platform has already added several high-potential tokens, including ADA, DOGE, XRP, SOL, and OP, further solidifying its dominance in the blockchain space. These listings cater to both retail and institutional investors, offering diverse opportunities in decentralized finance (DeFi) and beyond.

One of the most talked-about additions is Solana (SOL), which has regained traction after overcoming network congestion issues. With its high-speed transactions and low fees, SOL has become a favorite among traders. Similarly, Cardano (ADA) has seen renewed interest due to its robust smart contract capabilities and partnerships with governments for regulatory compliance. Meanwhile, Dogecoin (DOGE), often associated with Elon Musk’s tweets, continues to ride the meme coin wave, attracting both speculators and long-term holders.

Binance’s strategy in 2025 reflects a careful balance between innovation and regulatory compliance. Following the DOJ settlement and SEC lawsuit, the exchange has tightened its identity verification processes to prevent financial crimes and market manipulation. This shift has been crucial in rebuilding trust, especially in markets like the U.S., where Binance.US operates under stricter oversight. Changpeng Zhao’s departure and Yi He’s increased role in governance have also influenced the platform’s approach, emphasizing transparency and user protection.

For traders eyeing Binance new listings, here’s what to watch:

- Emerging DeFi projects: Binance has been keen on listing tokens that solve real-world problems, particularly in decentralized finance.

- Regulatory-friendly assets: With crypto regulations tightening globally, projects with clear compliance frameworks get priority.

- Community-driven tokens: Meme coins like DOGE and XRP, backed by strong communities, often see explosive growth post-listing.

The exchange’s native token, BNB, remains a cornerstone of its ecosystem, offering discounts on trading fees and access to exclusive launches. Meanwhile, heavyweights like Bitcoin and Ethereum continue to dominate trading volumes, but the spotlight is increasingly shifting to altcoins with unique use cases.

Despite the optimism, traders should stay vigilant against crypto scams. Binance has improved its screening processes, but bad actors still exploit hype around new listings. Always research projects thoroughly—check their whitepapers, team backgrounds, and regulatory compliance status before investing.

In summary, Binance new listings 2025 reflect a maturing crypto market where innovation meets accountability. Whether you’re a fan of Donald Trump’s pro-crypto stance or a follower of Elon Musk’s viral endorsements, staying informed is key to navigating this dynamic landscape. Keep an eye on Binance’s official announcements and leverage tools like identity verification and market analysis to make smarter trades.

Binance vs Competitors

Binance vs Competitors: How the Crypto Giant Stacks Up in 2025

Binance remains the undisputed leader in the crypto exchange space, but the competition has never been fiercer. While Binance dominates in trading volume, competitors like Coinbase, Kraken, and OKX are closing the gap with aggressive regulatory compliance strategies and niche offerings. One of Binance’s biggest advantages is its native token, BNB, which powers its ecosystem and offers reduced trading fees—a perk competitors struggle to match. However, the SEC lawsuit and DOJ settlement in 2024 forced Binance to overhaul its operations, giving rivals an opportunity to capitalize on its regulatory challenges.

Regulatory Battles and Market Trust

Binance’s legal troubles have been a double-edged sword. While the exchange paid billions in settlements and saw Changpeng Zhao (CZ) step down, his successor, Richard Teng, has prioritized transparency and compliance. Binance.US, the platform’s American arm, faced stricter crypto regulations, pushing some users toward Coinbase or Kraken, which have cleaner regulatory records. Meanwhile, Elon Musk’s rumored crypto project and Donald Trump’s pro-crypto policies have reshaped the market, creating new competitors overnight. Binance’s ability to adapt will determine whether it retains its crown.

Trading Pairs and Liquidity

Where Binance still shines is in its vast selection of trading pairs, including Bitcoin, Ethereum, ADA, DOGE, XRP, SOL, and OP. Competitors like Bybit and KuCoin offer similar diversity but lack Binance’s liquidity depth, which minimizes slippage for large traders. However, decentralized exchanges (DEXs) like Uniswap are gaining traction, especially among DeFi enthusiasts who prefer self-custody over centralized platforms. Binance’s hybrid approach—combining centralized efficiency with decentralized finance integrations—gives it an edge, but DEXs are eroding its dominance in niche markets.

User Experience and Security

Binance’s interface is packed with advanced tools, but newcomers often find it overwhelming. Competitors like Gemini and eToro focus on simplicity, appealing to casual investors. Security-wise, Binance has strengthened its identity verification processes post-settlement, but high-profile crypto scams and market manipulation allegations still haunt its reputation. In contrast, Kraken’s spotless security record and Coinbase’s insured custodial services attract risk-averse users.

The Future: Innovation or Stagnation?

Under Yi He’s leadership, Binance continues to innovate, experimenting with AI-driven trading and blockchain scalability solutions. However, competitors are catching up fast—Coinbase’s Layer 2 ecosystem and Kraken’s staking rewards are formidable alternatives. If Binance can leverage BNB’s utility and navigate crypto market regulations more deftly than rivals, it will stay ahead. But in 2025’s volatile landscape, even giants can stumble.

Binance Tax Reporting Tools

Binance Tax Reporting Tools have become essential for crypto traders navigating the increasingly complex regulatory landscape in 2025. With the SEC lawsuit and DOJ settlement behind them, Binance and Binance.US have doubled down on compliance, offering robust tools to help users accurately report transactions involving Bitcoin, Ethereum, BNB, and other major assets like ADA, DOGE, XRP, SOL, and OP. Whether you're a casual trader or a high-volume investor, these features simplify the daunting task of tracking gains, losses, and taxable events across thousands of trades.

One standout feature is the automated transaction history exporter, which categorizes trades, staking rewards, and DeFi activities into IRS-friendly formats like CSV or TurboTax-compatible files. For example, if you traded Ethereum for SOL during a market surge, the tool calculates your cost basis and capital gains in real time—saving hours of manual work. The platform also flags suspicious activity linked to crypto scams or market manipulation, adding a layer of transparency for users wary of financial crimes allegations.

Under CEO Richard Teng and co-founder Yi He, Binance has integrated identity verification checks into its tax tools, ensuring compliance with global crypto regulations. This is critical post-CFTC investigation, as regulators now demand clearer audit trails for digital assets. Even public figures like Elon Musk and Donald Trump, who’ve openly endorsed DOGE and other tokens, would benefit from these granular reports to avoid IRS scrutiny.

Here’s a pro tip: Always cross-check your Binance tax reports with third-party software if you’ve used multiple crypto exchanges. While Binance’s tools are powerful, they might not capture off-platform transfers—like moving Bitcoin to a cold wallet or swapping XRP on a blockchain DEX. The platform’s regulatory compliance team has also published guides on handling edge cases, such as NFTs or leveraged tokens, which the IRS now treats as taxable property.

For U.S. users, Binance.US offers a simplified version of these tools, tailored to IRS Form 8949 requirements. However, given the platform’s narrower asset selection (no ADA or SOL), active traders might need supplemental tracking for altcoins. The takeaway? Whether you’re a Changpeng Zhao-era loyalist or a newcomer, leveraging these tools is non-negotiable in 2025’s tightly monitored crypto market.

Finally, remember that crypto trading tax rules vary by jurisdiction. Binance’s geo-specific reporting modes adapt to regional laws, but consulting a tax professional is wise—especially if you’ve dabbled in decentralized finance or mined BNB during bull runs. The days of flying under the radar are over; today’s crypto regulations demand precision, and Binance’s toolkit delivers just that.