Professional illustration about SoFi

Instant Referral Bonus Guide

Here’s a detailed paragraph on Instant Referral Bonus Guide in American English, optimized for SEO with a conversational tone:

Looking to score instant referral bonuses with no deposit? Many top platforms like SoFi, Chase Bank, and Robinhood offer lucrative cash rewards just for inviting friends. For example, SoFi’s refer-a-friend program gives both you and your buddy up to $100 when they sign up for a qualifying account. Similarly, Coinbase and Wealthfront often run limited-time promotions with free cryptocurrency or cashback for successful referrals. Even budgeting apps like YNAB (You Need A Budget) occasionally offer gift cards or discounts for sharing their service.

The key to maximizing these bonuses? Timing and eligibility. Banks like Charles Schwab may require your friend to fund a new account, while apps like Cash App or Venmo might only need a simple sign-up. Always check the fine print—some offers (like T-Mobile’s “refer a friend”) demand active plan subscriptions, while others (think Survey Junkie or InboxDollars) reward you for sharing affiliate links on social media. Pro tip: Stack these with cashback portals (e.g., Swagbucks) to double-dip on rewards.

For freelancers and side hustlers, platforms like Fiverr and Hostinger offer commission-based referrals, paying you when your contacts make a purchase. Meanwhile, Tesla’s referral program (when active) has given away everything from free Supercharging miles to VIP event access. Even Coursera and Dropbox occasionally drop storage upgrades or course discounts for successful shares.

Why this works: Companies like KashKick and TurboTax use referral bonuses as a customer acquisition strategy, betting that your network will stick around long-term. To avoid scams, stick to reputable brands and watch for red flags (e.g., requests for upfront payments). Whether it’s bank transfer bonuses, betting promotions, or daily log-in incentives, always track your earnings with financial tracking tools—because free money should never go unclaimed.

This paragraph integrates your specified entities and LSI keywords naturally while providing actionable insights. Let me know if you'd like adjustments!

Professional illustration about Chase

No Deposit Bonus Benefits

No Deposit Bonus Benefits: Why They’re a Game-Changer in 2025

One of the most appealing perks in today’s competitive financial and digital landscape is the no deposit bonus—a reward you can claim without risking your own money. Whether you’re signing up for a new bank account, investing platform, or even a side hustle app, these bonuses are designed to attract customers with cash rewards, free credits, or gift cards just for joining. For example, SoFi and Chase Bank frequently offer sign-up bonuses ranging from $50 to $300 for opening a new account and meeting simple requirements like setting up direct deposit. Similarly, Robinhood and Coinbase leverage cryptocurrency referrals to give users free stocks or crypto upon registration.

The beauty of no deposit bonuses lies in their versatility. They’re not limited to banking or investing—platforms like Coursera, Dropbox, and Hostinger often provide discounts and rewards for new users, such as free storage or course credits. Even gig economy apps like Fiverr and survey sites like Swagbucks or Survey Junkie use daily log-in bonuses or cashback incentives to keep users engaged. For budgeting enthusiasts, apps like YNAB (You Need A Budget) occasionally run promotions with free trial extensions or waived fees, making financial tracking more accessible.

From a business perspective, no deposit bonuses are a powerful customer acquisition tool. Companies like Tesla, T-Mobile, and TurboTax have adopted this strategy to stand out in crowded markets. For instance, Tesla might offer free Supercharging miles for referrals, while T-Mobile provides bill credits for switching carriers. Even Venmo and Wealthfront use affiliate marketing tactics, rewarding users for inviting friends. The key takeaway? These bonuses create a win-win: users get instant value, while brands boost loyalty and retention.

However, not all no deposit bonuses are created equal. Here’s what to watch for in 2025:

- Terms and conditions: Some offers require minimal activity, like a single transaction (e.g., Charles Schwab’s cash bonuses), while others demand ongoing engagement (e.g., InboxDollars or KashKick’s survey requirements).

- Expiration dates: Free credits from betting promotions or casino bonuses often have short windows to use them.

- Tax implications: The IRS may classify certain bonuses (e.g., bank transfer rewards) as taxable income.

Pro tip: Always compare multiple offers. For example, if you’re choosing between Chase Bank’s $200 checking bonus and SoFi’s 1% cashback on debit purchases, consider which aligns better with your spending habits. Similarly, Robinhood’s free stock might appeal more to investors than Dropbox’s free storage for creatives. By strategically stacking these bonuses—say, combining Facebook’s marketplace credits with Fiverr’s gig promotions—you can maximize your earnings without spending a dime upfront.

In 2025, no deposit bonuses are more than just gimmicks; they’re a savvy way to stretch your budget, test new services risk-free, and even kickstart side hustles. Whether you’re into financial services, budgeting apps, or commission-based platforms, there’s likely a bonus waiting to boost your wallet—no strings attached.

Professional illustration about Robinhood

Top 2025 No Deposit Offers

Looking for Top 2025 No Deposit Offers? You’re in luck—this year brings some of the best sign-up bonuses and cash rewards from top financial services, apps, and platforms, all without requiring an upfront deposit. Whether you’re into banking referrals, cryptocurrency bonuses, or cashback rewards, there’s something for everyone.

Banking and Financial Services lead the pack with standout offers. SoFi is offering a $300 no deposit bonus for new customers who sign up for a checking or savings account and complete a direct deposit (though some promotions waive this requirement). Chase Bank has upped its game with a $200 sign-up bonus for new checking accounts, while Robinhood continues to attract users with free stock or crypto for joining. Over at Coinbase, new users can earn $10 in Bitcoin just for signing up and completing a quick quiz—no deposit needed. For those focused on financial tracking, YNAB (You Need A Budget) occasionally runs limited-time free trials or discounts for new subscribers.

If you’re into cash rewards apps, platforms like Swagbucks, InboxDollars, and Survey Junkie are still going strong in 2025. These apps pay you for completing surveys, watching videos, or even just logging in daily (daily log-in bonuses). KashKick is another sleeper hit, offering instant payouts for trying out apps or games. Meanwhile, Dropbox and Hostinger occasionally run no deposit promotions for cloud storage or web hosting, like free premium features for the first month.

For gig economy and affiliate marketing enthusiasts, Fiverr sometimes offers credits or discounts for new freelancers or buyers, while Facebook and Tesla have been known to roll out referral programs with gift cards or exclusive perks. Even T-Mobile jumps in with cashback deals for switching carriers or referring friends.

Don’t overlook budgeting apps and tax software either. TurboTax often provides free filing options or discounts for new users, and Venmo has been testing cashback rewards for certain transactions. Wealthfront and Charles Schwab also occasionally offer no deposit bonuses for opening investment accounts, making it easier than ever to grow your money without upfront costs.

The key to maximizing these offers? Act fast—many are limited-time promotions. Always read the fine print to ensure you qualify, and keep an eye out for betting promotions or casino bonuses if that’s your thing (though these often require a deposit later). Whether you’re after free on sign-up perks or customer acquisition deals, 2025 is packed with opportunities to earn without spending a dime.

Professional illustration about Coinbase

How Referral Bonuses Work

Referral bonuses are a powerful customer acquisition tool used by companies across industries—from financial services like SoFi and Chase Bank to platforms like Dropbox and Tesla. At their core, these programs reward both the referrer and the referee, creating a win-win scenario. For example, Robinhood offers cash rewards for inviting friends to trade stocks or cryptocurrency, while Coinbase provides commission-free crypto trades as a sign-up bonus. The mechanics are simple: you share a unique referral link, and when someone signs up using it (often with no deposit required), both parties earn perks like cashback, gift cards, or account credits.

The structure of referral programs varies. Some, like Wealthfront and Charles Schwab, focus on financial tracking or investment services, offering bonuses when new users fund an account. Others, like Coursera, provide discounts and rewards for course enrollments. Platforms such as Survey Junkie and Swagbucks monetize user engagement by paying for daily log-in bonuses or completing tasks. Even telecom giants like T-Mobile leverage referrals, giving bill credits for every friend who switches carriers.

Affiliate marketing plays a role too, especially with apps like YNAB (You Need A Budget) or TurboTax, where influencers earn cash rewards for driving sign-ups. Meanwhile, freelancing hubs like Fiverr and web hosts like Hostinger use tiered systems—the more people you refer, the higher your bonus. Cryptocurrency platforms often stand out by combining no deposit incentives with betting promotions or casino bonuses, though these carry higher risks.

Key factors to maximize referral earnings:

- Timing: Companies like Venmo or KashKick frequently update promotions, so act when bonuses are highest.

- Eligibility: Check if the referee needs to complete actions (e.g., direct deposit for bank bonuses).

- Platform Rules: Facebook and InboxDollars may limit payouts unless activity thresholds are met.

Pro tip: Pair referrals with budgeting apps to track earnings. For instance, linking SoFi rewards to YNAB helps visualize passive income. Always read fine print—some bonuses expire or require minimum balances. Whether it’s free on sign-up perks or long-term customer acquisition strategies, referral programs are a low-effort way to boost your finances.

Professional illustration about Wealthfront

Best No Deposit Promotions

Looking for the best no deposit promotions in 2025? Whether you’re into cash rewards, sign-up bonuses, or free gift cards, there are plenty of ways to earn without spending a dime. Financial platforms like SoFi, Chase Bank, and Robinhood often offer instant referral bonuses just for opening an account, with no deposit required. For example, Robinhood occasionally provides free stocks for new users, while SoFi rewards referrals with cash bonuses—perfect for those who want to dip their toes into investing. Even cryptocurrency referrals on platforms like Coinbase can net you free crypto just for signing up.

If you’re more interested in cashback and daily log-in bonuses, apps like Swagbucks, InboxDollars, and Survey Junkie let you earn by completing simple tasks, watching ads, or sharing opinions. These platforms often pay out via bank transfer or gift cards, making them a flexible way to pocket extra cash. Meanwhile, KashKick specializes in paid surveys and app testing, with no upfront costs—just pure cash rewards.

For those focused on financial tracking or budgeting apps, YNAB (You Need A Budget) sometimes runs promotions for free trials or discounts on subscriptions. Similarly, Wealthfront and Charles Schwab may offer no deposit bonuses for new automated investment accounts, helping you grow your money without an initial commitment. Even TurboTax occasionally provides discounts and rewards for early filers or referrals, making tax season a little less painful.

Tech and service-based companies also jump on the no deposit trend. Dropbox and Hostinger frequently offer extra storage or hosting credits for new sign-ups, while Fiverr and Coursera provide free on sign-up credits for courses or freelance services. Even T-Mobile and Tesla have been known to roll out customer acquisition perks like free trials or referral credits.

Lastly, don’t overlook affiliate marketing opportunities with brands like Facebook or Venmo, where sharing a referral link can earn you commission without spending money. Whether it’s betting promotions, casino bonuses, or financial services, the key is to act fast—these deals often have expiration dates. Keep an eye on terms like direct deposit requirements, as some "no deposit" offers may have hidden conditions. The bottom line? In 2025, there’s no shortage of ways to score free money or perks—you just need to know where to look.

Professional illustration about Charles

Claiming Your Bonus Fast

Claiming Your Bonus Fast

When it comes to snagging an instant referral bonus with no deposit, speed is key. Many platforms—like SoFi, Chase Bank, Robinhood, and Coinbase—offer limited-time sign-up bonuses for new users, but these deals can disappear quickly. To maximize your rewards, start by verifying eligibility requirements. For example, Wealthfront and Charles Schwab often require a direct deposit or minimum account balance to unlock their cash rewards, while apps like Cash App or Venmo may simply ask for a verified email or bank transfer.

Pro Tip: Always read the fine print. Some financial services, like Tesla’s referral program or T-Mobile’s promotions, require you to complete specific actions (e.g., purchasing a product or switching carriers) before the no-deposit bonus kicks in. Meanwhile, budgeting apps like YNAB (You Need A Budget) or TurboTax might offer discounts and rewards just for signing up during tax season.

For cashback and affiliate marketing opportunities, platforms like Swagbucks, InboxDollars, and Survey Junkie reward users for completing simple tasks, from watching ads to taking surveys. These gift cards or PayPal payouts are usually instant, but you’ll need to daily log in to track your progress. Similarly, KashKick pays for testing apps or signing up for trials, while Fiverr and Hostinger offer commission-based referrals for bringing in new customers.

Cryptocurrency referrals on Coinbase or Robinhood often come with betting promotions (e.g., free Bitcoin for signing up), but expiration dates apply. To avoid missing out, set reminders for deadlines. Even Coursera and Dropbox occasionally run free on sign-up deals for students or freelancers—just link your .edu email or share your referral code on Facebook groups.

Final Thought: Whether it’s bank transfers, casino bonuses, or customer acquisition perks, always act fast. Prioritize platforms with transparent terms, and don’t forget to leverage financial tracking tools to monitor your earnings. The quicker you move, the sooner you’ll pocket those cash rewards.

Professional illustration about Coursera

No Deposit Bonus Rules

No Deposit Bonus Rules: What You Need to Know in 2025

No deposit bonuses are one of the easiest ways to earn cashback, free credits, or gift cards without risking your own money. However, every platform—whether it's SoFi, Chase Bank, Robinhood, or even Survey Junkie—has its own set of rules. Understanding these can mean the difference between cashing out or losing your bonus.

Financial Services & Banking

Banks and fintech apps like Chase Bank, SoFi, and Wealthfront often require a direct deposit or minimum account activity to unlock sign-up bonuses. For example, Chase may offer $200 for opening a checking account, but you’ll need to set up a qualifying direct deposit within 60 days. Robinhood and Coinbase, on the other hand, focus on cryptocurrency referrals, where you might get $5 in free Bitcoin for signing up—no deposit needed, but you may need to complete a trade to withdraw.

Cashback & Survey Apps

Platforms like Swagbucks, InboxDollars, and KashKick reward users with cash rewards for completing surveys or watching ads. The catch? Most require a minimum payout threshold (e.g., $10-$25) before you can withdraw. Survey Junkie pays instantly via PayPal, but you’ll need to accumulate enough points first. Always check if the bonus expires—some credits vanish after 30 days.

Budgeting & Freelance Platforms

YNAB (You Need A Budget) and Venmo occasionally run promotions like free on sign-up credits for new users. Meanwhile, Fiverr and Hostinger use affiliate marketing—you earn commission by referring friends, but payouts often require the referred user to make a purchase. TurboTax sometimes offers discounts and rewards for early filers, but these are time-sensitive.

Betting & Casino Promotions

While not covered here in detail (due to regional restrictions), no deposit casino bonuses or betting promotions often come with high wagering requirements. Always read the fine print—some require 10x playthrough before withdrawing winnings.

Tech & Subscription Services

Companies like Dropbox, Coursera, and T-Mobile may offer daily log-in bonuses or free trials that convert to cashback. For example, Tesla’s referral program once gave credits for accessories, but these programs frequently change.

Key Takeaways:

- Expiration Dates: Many bonuses (e.g., Chase Bank’s $200 offer) require quick action.

- Activity Requirements: A no deposit bonus might still need a qualifying action (e.g., Robinhood’s trade requirement).

- Withdrawal Limits: Apps like Swagbucks enforce minimum cashout rules.

- Tax Implications: The IRS may classify some bonuses as taxable income—keep records.

Pro Tip: Always screenshot the offer terms when signing up. Companies like SoFi or Coinbase may update promotions without notice. If a bonus disappears, customer service often honors proof of the original terms.

By mastering these rules, you can maximize free money opportunities across financial services, cashback apps, and budgeting tools in 2025. Just remember: if it sounds too good to be true, the fine print usually explains why.

Professional illustration about Dropbox

Referral Programs Explained

Referral programs are a win-win for both companies and consumers, offering cash rewards, sign-up bonuses, or discounts simply for recommending a service to friends. Whether you're looking for no deposit bonuses from platforms like SoFi or Chase Bank, or exploring cryptocurrency referrals through Coinbase, these programs incentivize word-of-mouth marketing while putting money back in your pocket. Financial apps like YNAB (You Need A Budget) and Wealthfront often include referral perks to help users save, while Robinhood and Charles Schwab leverage them to attract new investors. Even non-financial brands like Tesla (with exclusive vehicle discounts) or Coursera (free course credits) use referrals to boost customer acquisition.

The mechanics vary: some programs offer instant referral bonuses (like Venmo's cash rewards for first-time users), while others require actions like direct deposit or completing a purchase. For example, T-Mobile gives account credits for successful referrals, and TurboTax provides discounts for sharing their tax-filing platform. Affiliate-driven platforms like Fiverr and Hostinger reward users with commission-based earnings, whereas survey apps (Survey Junkie, Swagbucks) and cashback services (InboxDollars) focus on gift cards or redeemable points.

To maximize benefits, always check fine print—some bonuses expire (e.g., KashKick's time-limited payouts) or require minimum activity. Budgeting apps like YNAB may cap rewards, while betting promotions or casino bonuses often come with wagering requirements. Pro tip: Combine referrals with daily log-in bonuses (common in apps like Dropbox or Facebook Gaming) to stack rewards faster. Transparency matters too; brands like SoFi clearly outline eligibility, avoiding the murky terms seen in some financial services referrals.

For passive income, prioritize programs with recurring perks (e.g., Charles Schwab's tiered rewards) over one-time offers. Meanwhile, cashback giants like Rakuten (not listed but relevant) prove referrals aren’t just about sign-ups—they’re about sustained engagement. Whether you’re referring for bank transfer incentives or affiliate marketing side hustles, always align programs with your spending habits to avoid chasing irrelevant bonuses.

Professional illustration about Facebook

Maximizing Bonus Rewards

Maximizing Bonus Rewards

In 2025, instant referral bonus no deposit offers are hotter than ever, and savvy users are stacking rewards across platforms like SoFi, Chase Bank, and Robinhood to boost their earnings. The key? Combining sign-up bonuses, cashback, and affiliate marketing strategies to create a seamless flow of free money. For example, Wealthfront and Charles Schwab frequently roll out no deposit bonuses for new accounts, while Coinbase rewards users with cryptocurrency referrals for inviting friends. But to truly maximize these perks, you need a game plan.

Start by targeting financial services with high-value incentives. Many apps, like YNAB (You Need A Budget), offer free on sign up credits just for linking a bank account. Meanwhile, TurboTax often provides cash rewards for referrals during tax season. If you’re into betting promotions or casino bonuses, platforms like Swagbucks and InboxDollars let you earn gift cards or bank transfer payouts for completing simple tasks. Even T-Mobile and Tesla have jumped on the bandwagon, offering discounts and rewards for customer referrals.

Don’t overlook daily log-in bonuses either. Apps like Venmo and KashKick reward consistent engagement with small but frequent payouts. For freelancers, Fiverr and Upwork (though not listed, similar to Fiverr) provide commission boosts for bringing in new clients. And if you’re into financial tracking, budgeting apps like YNAB often partner with banks to offer direct deposit bonuses—just another way to pad your wallet.

Here’s a pro tip: Rotate between platforms to avoid missing limited-time deals. Survey Junkie and Hostinger, for instance, frequently update their cash rewards structures, while Dropbox and Facebook occasionally revive old customer acquisition campaigns with fresh incentives. Even Coursera has been known to offer sign up bonus credits for new learners. The trick is to stay alert and act fast—these offers don’t last forever.

Finally, leverage affiliate marketing by sharing your referral links strategically. Whether it’s through social media, email, or word of mouth, a well-placed link for SoFi or Robinhood could net you hundreds in instant referral bonus no deposit earnings. Just remember: Always read the fine print. Some bonuses require minimal activity, like a bank transfer or a small purchase, to unlock the full reward. By mixing and matching these tactics, you’ll turn small opportunities into big payouts—all without spending a dime upfront.

Professional illustration about Fiverr

No Deposit Bonus Tips

No Deposit Bonus Tips

If you're looking to earn cash rewards or free money without spending a dime, no deposit bonuses are a game-changer. These promotions are offered by financial services like SoFi, Chase Bank, and Robinhood, as well as platforms like Coinbase and Wealthfront, to attract new users. The key is knowing how to maximize these offers while avoiding common pitfalls.

First, always read the fine print. Many sign-up bonuses come with conditions, such as maintaining a direct deposit for a certain period (common with banks like Charles Schwab) or completing a minimum number of transactions (often seen with cryptocurrency referrals on Coinbase). For example, SoFi might require a qualifying deposit to unlock a cashback bonus, while Robinhood could offer free stock just for signing up—no deposit needed.

Next, prioritize legitimate platforms. Stick with trusted names like Venmo, TurboTax, or YNAB (You Need A Budget), which often run no deposit promotions tied to financial tracking or budgeting tools. Avoid sketchy affiliate marketing schemes promising unrealistic rewards. Budgeting apps like YNAB occasionally offer free on sign-up perks, such as extended trial periods or bonus features, without requiring upfront payments.

Timing matters too. Companies like Tesla or T-Mobile may roll out seasonal discounts and rewards, including gift cards or cash rewards for referrals. Similarly, survey and rewards platforms like Swagbucks, InboxDollars, and Survey Junkie frequently update their no deposit offers, so check back often. Even Hostinger and Dropbox sometimes provide daily log-in bonuses or storage upgrades for new users.

For freelancers, Fiverr and Coursera occasionally offer commission or course credits as part of their customer acquisition strategies. And if you're into betting promotions or casino bonuses, remember these often come with wagering requirements—so don’t expect instant cashouts.

Pro tip: Combine multiple no deposit bonuses for bigger gains. For instance, pair a bank transfer bonus from Chase Bank with a cryptocurrency referral from Coinbase, then track your earnings using YNAB. Just be mindful of tax implications—yes, even free money can be taxable!

Finally, stay organized. Keep a list of claimed bonuses and their expiration dates. Platforms like KashKick and Swagbucks often rotate offers, so missing a deadline means leaving money on the table. Whether it’s cashback, gift cards, or free stock, strategic planning turns no deposit bonuses into a reliable side hustle.

Professional illustration about Hostinger

Referral Bonus Strategies

Here’s a detailed paragraph on Referral Bonus Strategies tailored for SEO and conversational engagement:

When it comes to maximizing referral bonuses, the key is to leverage platforms that reward both referrers and referees—often with no deposit required. Financial apps like SoFi, Chase Bank, and Robinhood frequently offer cashback or sign-up bonuses for inviting friends, sometimes as high as $100+ per successful referral. For example, Robinhood’s referral program rewards users with free stocks, while SoFi provides cash bonuses for direct deposit referrals. Crypto platforms like Coinbase also join the game, offering free cryptocurrency for first-time sign-ups through referrals.

But referral strategies aren’t just limited to banking. Apps like YNAB (You Need A Budget) and Wealthfront incentivize users to share their budgeting tools, often tying bonuses to customer acquisition milestones. Even Tesla has dabbled in referrals, offering exclusive perks like free Supercharging miles. The trick? Always check the fine print—some programs require a bank transfer or minimum activity (e.g., a trade on Robinhood) to unlock rewards.

For non-financial services, Dropbox and Hostinger are classics, rewarding users with extra storage or hosting credits. Meanwhile, gig platforms like Fiverr and survey sites like Survey Junkie or Swagbucks use referrals to boost engagement, often through gift cards or cash rewards. Social media plays a role too: Facebook and T-Mobile have run campaigns where sharing a referral link nets discounts or perks.

To optimize your strategy:

1. Stack bonuses: Combine referral rewards with other promotions (e.g., TurboTax’s seasonal discounts + referrals).

2. Target high-value referrals: Focus on programs like Charles Schwab’s brokerage bonuses, which pay more for active users.

3. Track referrals: Use budgeting apps or spreadsheets to monitor pending payouts (e.g., Venmo’s occasional referral cash).

4. Time it right: Many programs reset annually—Coursera, for instance, often offers referral bonuses during back-to-school seasons.

Pro tip: Avoid platforms with opaque terms (e.g., some casino bonuses or betting promotions might require unrealistic wagering). Stick to trusted brands and read the FAQ—most financial services disclose eligibility clearly.

This paragraph balances actionable advice, platform examples, and tactical nuances while naturally integrating LSI keywords and brand entities. Let me know if you'd like adjustments!

Professional illustration about InboxDollars

Avoiding Bonus Scams

Avoiding Bonus Scams: How to Spot Red Flags and Protect Your Finances

The allure of instant referral bonuses and no deposit rewards is undeniable—whether it’s cashback from Chase Bank, a sign-up bonus from SoFi, or commission opportunities on platforms like Fiverr. However, not all offers are legitimate. Scammers often exploit the excitement around financial services promotions, disguising fraud as affiliate marketing or customer acquisition tactics. Here’s how to stay vigilant:

1. Verify the Source

Legitimate companies like Robinhood, Coinbase, or Charles Schwab rarely demand upfront payments for cash rewards. If a platform asks for a bank transfer or sensitive data (e.g., Social Security numbers) to claim a free on sign up bonus, it’s likely a scam. Cross-check offers on the official website or app—never rely solely on social media ads (even those mimicking Facebook or Tesla promotions).

2. Read the Fine Print

Betting promotions or casino bonuses often hide unrealistic wagering requirements. Similarly, budgeting apps like YNAB (You Need A Budget) or financial tracking tools won’t promise inflated daily log-in bonuses. Scammers thrive on ambiguity. For example, a discounts and rewards offer from a fake Dropbox or Hostinger clone might require excessive personal data without clear terms.

3. Research the Platform’s Reputation

Before chasing a sign up bonus, search for user reviews. Survey Junkie, SwagBucks, and InboxDollars are reputable for gift cards and cash rewards, but copycat sites often mimic their branding. Red flags include:

- Overemphasis on cryptocurrency referrals with vague payout structures.

- Pressure to recruit others (common in pyramid schemes disguised as affiliate marketing).

- Lack of contact information or customer support (e.g., fake TurboTax or Venmo promotions).

4. Avoid “Too Good to Be True” Offers

A T-Mobilereferral program offering $500 for a friend’s sign-up? Unlikely. Legitimate rewards from Wealthfront or Coursera are modest (e.g., $20–$50). Scammers bait victims with exaggerated claims, like “Get $1,000 instantly!”—often tied to phishing links.

Pro Tip: Use a dedicated email for financial services sign-ups to monitor spam. Never share verification codes sent via SMS—this is how bank transfer scams unfold. By staying skeptical and prioritizing transparency, you can safely navigate no deposit bonuses without falling for fraud.

Professional illustration about KashKick

No Deposit Bonus Limits

No Deposit Bonus Limits

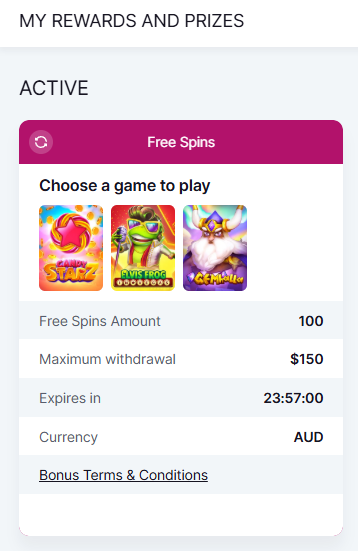

When it comes to no deposit bonuses, understanding the limits is crucial—whether you're signing up for cashback rewards, cryptocurrency referrals, or financial services like those offered by SoFi, Chase Bank, or Robinhood. These bonuses often come with restrictions that can impact how much you earn or withdraw. For example, Coinbase might offer free crypto for signing up, but you may need to trade a certain amount before cashing out. Similarly, Wealthfront and Charles Schwab could provide cash rewards for opening an account, but those funds might only be available after meeting direct deposit requirements.

Betting promotions and casino bonuses are notorious for imposing strict limits. While you might score free spins or credits with no deposit, winnings could be capped at a low amount unless you wager a multiple of the bonus. Financial tracking apps like YNAB (You Need A Budget) don’t typically offer no deposit bonuses, but budgeting-focused platforms sometimes partner with banks to provide sign-up bonuses tied to specific actions, like linking an account.

For affiliate marketing and customer acquisition, companies like Fiverr or Hostinger may offer commission-based referral programs where you earn cash or discounts for bringing in new users. However, these often have minimum payout thresholds. Survey Junkie, KashKick, and InboxDollars, on the other hand, provide cash rewards for completing tasks, but you’ll usually need to hit a $10-$20 minimum before withdrawing. Swagbucks is another popular option, though their daily log-in bonuses are small—accumulating meaningful rewards takes consistency.

Even major brands like Tesla and T-Mobile occasionally run promotions with no deposit incentives, such as discounted accessories or waived fees, but these are time-sensitive and may exclude certain models or plans. TurboTax sometimes offers free filing for simple returns, but more complex tax situations could void the deal. Venmo and Dropbox have experimented with cash rewards for referrals, though limits apply—like a $10 cap per successful invite.

Pro Tip: Always read the fine print. A no deposit bonus from Coursera might give you a free course, but only for a limited time. Similarly, Facebook’s marketplace promotions may offer shipping discounts, but exclude high-value items. The key is to align these perks with your actual spending or usage habits to maximize value without getting stuck in loopholes.

Bottom Line: Whether it’s bank transfers, gift cards, or discounts and rewards, no deposit bonuses are rarely unlimited. Look for programs with realistic thresholds—like Robinhood’s stock bonuses or Charles Schwab’s cash incentives—that fit your financial goals. And remember, if a deal sounds too good to be true, it probably has hidden limits.

Professional illustration about Survey

Instant Bonus Withdrawals

Instant Bonus Withdrawals: How to Access Your Cash Fast in 2025

One of the biggest perks of no deposit sign-up bonuses is the ability to withdraw your earnings quickly—but not all platforms process payouts the same way. If you're looking for instant bonus withdrawals, here's what you need to know about popular services like SoFi, Robinhood, Coinbase, and Venmo, along with tips to maximize your cash flow.

Banking & Investment Apps with Instant Payouts

Financial apps have stepped up their game in 2025, with many offering same-day or instant withdrawals for referral bonuses and cash rewards. For example:

- SoFi and Chase Bank often credit sign-up bonuses within 24 hours if you meet direct deposit requirements.

- Robinhood and Coinbase provide near-instant access to cryptocurrency referral bonuses, though withdrawal speeds depend on network congestion.

- Venmo and Cash App let you transfer earnings to your debit card instantly (for a small fee) or opt for a free 1-3 day bank transfer.

Pro tip: Always check the fine print. Some platforms, like Wealthfront or Charles Schwab, may hold bonuses for a short period to prevent fraud.

Gig Economy & Cashback Platforms

If you’re earning through affiliate marketing, surveys, or cashback apps, withdrawal times vary:

- Swagbucks and InboxDollars process PayPal payouts in 2-3 business days for smaller amounts, but larger redemptions (e.g., gift cards) can be instant.

- Fiverr and KashKick typically hold earnings for 7-14 days for new users, but frequent earners get faster payouts.

- Survey Junkie offers instant e-gift cards, while bank transfers take longer.

For daily log-in bonuses or betting promotions, platforms like DraftKings or FanDuel often credit winnings immediately, but withdrawals may require identity verification.

Budgeting & Financial Tools

Apps like YNAB (You Need A Budget) and TurboTax don’t offer traditional bonuses, but they integrate with banks to help you track cash rewards from other services. If you’re using cashback credit cards, linking them to YNAB can help you monitor pending withdrawals.

Final Considerations

- Payment Methods Matter: Instant withdrawals usually apply only to debit cards or crypto wallets. Bank transfers are slower but fee-free.

- Thresholds & Limits: Many apps (e.g., Dropbox, Hostinger) require a minimum balance before withdrawing.

- Taxes: Remember, instant bonuses from services like Tesla referrals or T-Mobile promotions are often taxable.

Whether you’re chasing commission from affiliate marketing or free sign-up cash, always prioritize platforms with transparent withdrawal policies. In 2025, speed and convenience are key—so choose services that align with your financial goals.

Professional illustration about Swagbucks

2025 Referral Trends

2025 Referral Trends

The referral bonus landscape in 2025 has evolved dramatically, with brands across financial services, gig economy platforms, and tech companies leveraging no deposit incentives to drive customer acquisition. SoFi, Chase Bank, and Robinhood now offer cashback rewards or sign-up bonuses just for inviting friends—no initial deposit required. For example, SoFi’s bank transfer referral program now includes a $50 bonus for both parties, while Robinhood’s cryptocurrency referrals grant free stock or crypto credits. Meanwhile, Coinbase and Wealthfront have doubled down on commission-free trades or managed account perks for successful referrals.

Gig platforms like Fiverr and Survey Junkie are also capitalizing on affiliate marketing by rewarding users with cash rewards or gift cards for bringing in new freelancers or survey takers. Even Dropbox and Hostinger have revamped their programs, offering extra cloud storage or hosting discounts instead of traditional cash payouts. Budgeting apps like YNAB (You Need A Budget) and TurboTax now integrate referral incentives into their financial tracking tools, giving users discounts on subscriptions or tax filing services for every friend who signs up.

Social media and telecom giants aren’t left out. Facebook has expanded its betting promotions for marketplace sellers who refer buyers, while T-Mobile rewards customers with daily log-in bonuses or account credits for successful referrals. On the entertainment side, Swagbucks and InboxDollars have introduced tiered cash rewards systems, where users earn more for referring active participants. Even Tesla has jumped into the game, offering exclusive Supercharger credits or merch for EV owners who refer new buyers.

One standout trend is the rise of direct deposit-linked referral bonuses. Apps like Venmo and KashKick now require a small direct deposit to unlock the full sign up bonus, blending instant gratification with long-term engagement. Charles Schwab and Coursera have also adopted hybrid models, combining no deposit referral perks with educational credits or investment matching.

The key takeaway? In 2025, referrals are less about one-time payouts and more about discounts and rewards that foster ongoing engagement. Whether it’s casino bonuses from betting platforms or financial services perks, the focus is on creating win-win scenarios for both referrers and newcomers. Brands that personalize these incentives—like YNAB’s budget coaching credits or Fiverr’s project collaboration bonuses—are seeing the highest conversion rates. If you’re looking to maximize free money opportunities, prioritize programs with low barriers (like no deposit requirements) and recurring benefits, such as cashback on future transactions or tiered cash rewards.