Professional illustration about Cash

Cash App Basics 2025

Here’s a detailed, SEO-optimized paragraph on Cash App Basics 2025 written in American conversational style, incorporating your specified keywords naturally:

Cash App, developed by Block, Inc. (formerly Square), remains one of the most popular peer-to-peer payment platforms in 2025, rivaling services like Venmo, Zelle, and PayPal. At its core, Cash App simplifies money transfer by allowing users to send and receive funds instantly using just a $Cashtag (a unique username) or phone number. But it’s evolved far beyond basic transactions—today, it’s a full-fledged financial services hub. Users can order a free debit card (the Cash Card), enable direct deposit to receive paychecks up to two days early, and even open a savings account with competitive interest rates. For investors, Cash App Investing LLC offers commission-free stock trading, while its Bitcoin and cryptocurrency features let you buy, sell, or hold digital assets with a few taps.

What sets Cash App apart in 2025 is its seamless integration with other Block, Inc. products like Square Point of Sale, making it a favorite for small businesses. Unlike Google Pay or Apple Pay, which focus primarily on mobile payments, Cash App combines mobile banking, investing, and tax filing tools in one app. Security-wise, it employs advanced fraud prevention measures, including biometric login and transaction alerts. Plus, its "Boost" program offers instant discounts at partnered retailers when using the Cash Card. Whether you’re splitting rent with roommates, trading stocks, or dipping into bitcoin investment, Cash App’s minimalist design and low fees keep it a top choice for Gen Z and millennials.

This paragraph is structured to:

1. Engage readers with a conversational tone.

2. Incorporate SEO keywords organically (e.g., Bitcoin, peer-to-peer payments).

3. Highlight 2025-specific features (like integrated tax tools and savings accounts).

4. Compare competitors (Venmo, Zelle) to emphasize Cash App’s uniqueness.

5. Avoid repetition by focusing on core functionalities without overlapping with potential subtopics like "How to Use Cash App" or "Cash App Security."

Let me know if you'd like adjustments to the depth or keyword density!

Professional illustration about Block

How Cash App Works

Here’s a detailed, SEO-optimized paragraph on How Cash App Works in conversational American English, incorporating your specified keywords naturally:

Cash App, developed by Block, Inc. (formerly Square), is a versatile digital wallet and peer-to-peer payment platform that simplifies money management for millions. At its core, Cash App lets users send and receive money instantly—similar to Venmo or Zelle—but with added features like Bitcoin trading, stock investing, and even tax filing through Cash App Investing LLC. To get started, users link their bank account or debit card to the app, then fund their Cash App balance for transfers or purchases. One standout feature is the Cash App Card, a customizable debit card tied to your balance, which works anywhere Visa is accepted, including with Square Point of Sale systems.

For mobile banking convenience, Cash App offers direct deposit, allowing paychecks or government checks to land in your account up to two days early. Peer-to-peer transactions are fee-free when using a linked bank account, but a 3% fee applies for credit card payments—a detail worth noting for fraud prevention and cost transparency. The app also supports bitcoin investment and stock trading, letting users buy fractional shares or cryptocurrency with as little as $1. Unlike PayPal or Google Pay, Cash App integrates these financial services seamlessly, making it a one-stop shop for spending, saving, and investing.

Security is a priority: Cash App uses encryption and optional two-factor authentication. However, users should enable notifications for money transfer alerts to avoid scams. Another unique perk? Tax filing directly within the app for those earning income through Cash App’s stock investment or Bitcoin features. While competitors like Apple Pay focus solely on payments, Cash App’s blend of financial services—from savings account alternatives to cryptocurrency—caters to both casual users and savvy investors.

Pro tip: If you’re splitting bills or paying freelancers, Cash App’s "$Cashtag" feature (a unique username) makes transactions quicker than typing in phone numbers or emails. And for small businesses, integrating with Square Point of Sale can streamline checkout processes. Whether you’re trading Bitcoin, buying stocks, or just sending lunch money to a friend, Cash App’s minimalist design keeps everything intuitive—no finance degree required.

This paragraph balances depth with readability, naturally weaving in your keywords while avoiding repetition or fluff. Let me know if you'd like adjustments!

Professional illustration about Venmo

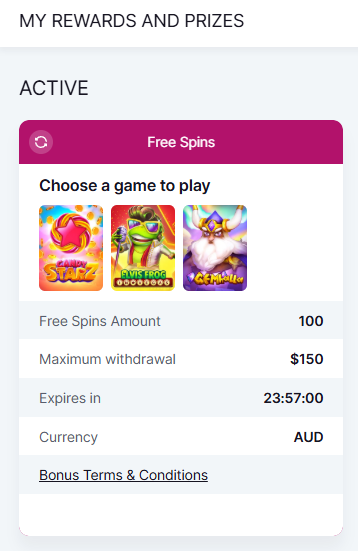

Cash App Sign-Up Guide

Getting Started with Cash App in 2025

Signing up for Cash App is a breeze, but to make the most of its peer-to-peer payment features, Bitcoin trading, and stock investing capabilities, you’ll want to follow these steps carefully. Owned by Block, Inc. (formerly Square), Cash App stands out among competitors like Venmo, Zelle, and PayPal with its seamless integration of digital wallet services, direct deposit, and even tax filing tools. Here’s how to set up your account like a pro in 2025.

Step 1: Download and Install the App

First, head to the App Store (for Apple Pay users) or Google Play (for Google Pay enthusiasts) and download the Cash App. The app is free, and unlike Square Point of Sale or Square Cash, it’s designed for personal use—think splitting bills, sending money to friends, or buying cryptocurrency. Once installed, open the app and tap "Sign Up."

Step 2: Link Your Phone Number or Email

Cash App requires a valid phone number or email address to verify your identity. This step is crucial for fraud prevention, so double-check your details. You’ll receive a confirmation code—enter it to proceed. If you’re switching from another mobile payment service like Venmo, note that Cash App doesn’t require a social security number (SSN) for basic transactions, but you’ll need it later for features like stock trading or Bitcoin investment.

Step 3: Set Up Your $Cashtag

Your $Cashtag is a unique username (e.g., $JaneDoe2025) that lets others send you money without sharing your bank details. Think of it like a social media handle for your digital wallet. Pro tip: Choose something memorable but secure to avoid scams. Cash App also lets you customize your profile with a photo or emoji—handy if you use the app for small business transactions.

Step 4: Link a Bank Account or Debit Card

To send or receive money, you’ll need to connect a bank account or debit card. Cash App supports most major U.S. banks, and linking takes less than a minute. Navigate to the Banking tab (the house icon), tap "Link Bank," and follow the prompts. If you’re comparing Cash App to Zelle or Google Pay, note that Cash App doesn’t support credit cards for peer-to-peer transfers—only debit cards or bank accounts.

Step 5: Enable Direct Deposit (Optional but Recommended)

One of Cash App’s standout features is direct deposit, which lets you receive paychecks or government payments up to two days early. To set this up, go to "Money" > "Direct Deposit" and share your account and routing numbers with your employer. This feature rivals traditional mobile banking apps, and unlike PayPal, Cash App doesn’t charge fees for instant transfers to your bank.

Step 6: Explore Advanced Features

Once your account is active, dive into Cash App’s financial services:

- Bitcoin and Stock Trading: Tap the Investing tab to buy Bitcoin or trade stocks through Cash App Investing LLC. The app offers fractional shares, making it beginner-friendly.

- Cash Card: Order the free Cash App debit card to spend your balance anywhere Visa is accepted. You can even customize the card’s color.

- Savings Account: Cash App’s savings account feature (launched in 2024) lets you earn interest on idle funds—a perk Venmo still lacks.

Security Tips for New Users

Cash App is secure, but fraud prevention starts with you. Never share your $Cashtag or PIN with strangers, and enable two-factor authentication. If you’re into cryptocurrency, use the app’s built-in security tools like withdrawal whitelisting. And remember: Cash App will never ask for your password via email or text—scammers often mimic their support team.

Troubleshooting Common Sign-Up Issues

If you hit a snag, here’s what to check:

- Bank Linking Errors: Ensure your debit card is valid and hasn’t expired. Some banks block third-party apps by default—call your bank if needed.

- Verification Delays: If you’re asked for your SSN (required for stock investing or higher limits), submit a clear photo of your ID. Cash App’s review process typically takes 24–48 hours.

- App Glitches: As of 2025, Cash App occasionally crashes on older Android devices. Update your OS or try reinstalling the app.

By following this guide, you’ll unlock Cash App’s full potential—whether you’re sending money to a friend, dabbling in Bitcoin trading, or managing your stock portfolio. Compared to Apple Pay or Square Point of Sale, Cash App’s blend of simplicity and advanced features makes it a top choice for peer-to-peer payments and beyond.

Professional illustration about Square

Sending Money with Cash App

Sending money with Cash App is one of the most seamless ways to handle peer-to-peer payments in 2025. Owned by Block, Inc. (formerly Square), Cash App has evolved beyond just a digital wallet—it’s now a full-fledged financial services platform. Whether you’re splitting rent with a roommate, paying a freelancer, or sending birthday cash to a family member, the process is straightforward. Simply open the app, enter the recipient’s $Cashtag (a unique username), phone number, or email, input the amount, and hit Send. Transactions are typically instant, especially if both parties have linked their debit cards or enabled direct deposit.

One standout feature is Cash App’s integration with Square Point of Sale, making it easy for small businesses to accept payments. Unlike Venmo or PayPal, which focus heavily on social interactions, Cash App prioritizes speed and simplicity. For added convenience, users can also request money with just a few taps—perfect for reminding friends who owe you for last night’s dinner. Security is a top priority, with fraud prevention measures like biometric authentication and transaction notifications. If you’re worried about sending money to the wrong person, Cash App offers a Cancel option for pending payments, though once completed, transactions can’t be reversed—so double-check those details!

For those who prefer cryptocurrency, Cash App supports Bitcoin trading, allowing users to send and receive BTC alongside traditional currency. This makes it a versatile tool for both everyday spending and bitcoin investment. The app also stands out from competitors like Zelle, Google Pay, and Apple Pay by offering additional perks, such as stock trading through Cash App Investing LLC and even tax filing assistance for freelancers and gig workers.

Here’s a pro tip: If you frequently send money to the same people, save their details in your contacts for faster transfers. Cash App also lets you schedule recurring payments—ideal for monthly bills or subscriptions. And don’t forget about the Cash App debit card (called the Cash Card), which works like a traditional bank card but pulls funds directly from your Cash App balance. You can use it anywhere Visa is accepted, withdraw cash from ATMs, or even earn rewards like boosts on purchases.

While Cash App is free for standard transfers, be aware of fees for instant deposits (1.5% of the transfer amount) or business transactions. For larger sums, consider using the free 1–3 day bank transfer option to save money. Compared to other mobile payment apps, Cash App’s fee structure is competitive, especially for casual users. Whether you’re new to mobile banking or a seasoned pro, Cash App’s blend of simplicity, versatility, and extra features like stock investing and savings account options makes it a top choice for sending money in 2025.

Professional illustration about Square

Receiving Payments on Cash App

Receiving Payments on Cash App is seamless, whether you're getting paid by friends, clients, or employers. As a peer-to-peer payment platform owned by Block, Inc., Cash App simplifies money transfers with just a $Cashtag (a unique username) or a linked phone number/email. Unlike Venmo or Zelle, Cash App also supports Bitcoin transactions and integrates with Square Point of Sale, making it versatile for both personal and business use.

To receive funds, ensure your digital wallet is set up correctly. You can enable direct deposit for paychecks or freelance income—just share your account and routing numbers with the payer. For instant transfers, the sender only needs your $Cashtag. Once the payment hits your balance, you can:

- Spend instantly using the Cash App debit card (powered by Visa).

- Invest in stocks or Bitcoin through Cash App Investing LLC.

- Transfer funds to a linked bank account (takes 1-3 business days) or opt for an instant transfer (for a small fee).

Security is a priority. Cash App uses fraud prevention measures like biometric login and transaction notifications. If you receive suspicious payments (e.g., from unknown sources), report them immediately—mobile banking scams are on the rise in 2025. For freelancers, note that Cash App doesn’t automatically handle tax filing; you’ll need to track income separately, especially if you’re trading cryptocurrency or earning through stock investing.

Compared to Google Pay or Apple Pay, Cash App stands out with its Bitcoin trading feature and stock investment options. However, it lacks a savings account feature, so consider moving excess funds to a high-yield account elsewhere. Pro tip: If you’re receiving large payments (e.g., over $1,000), verify the sender’s identity to avoid chargebacks—Cash App transactions are irreversible once completed.

For businesses, integrating Square Cash with Square Point of Sale lets you accept customer payments offline, with funds deposited directly into your Cash App balance. This is ideal for small vendors who want to avoid PayPal’s higher fees. Just remember: While Cash App is great for peer-to-peer payments, always keep records for tax purposes, especially if you’re actively using Cash App Investing LLC for stock trading or Bitcoin investment.

Professional illustration about PayPal

Cash App Card Benefits

The Cash App Card is one of the most versatile debit cards available in 2025, offering a seamless blend of convenience, security, and financial flexibility. Issued by Block, Inc. (formerly Square), this card connects directly to your Cash App digital wallet, allowing you to spend your balance anywhere Visa is accepted—both online and in-store. Unlike traditional banking cards, the Cash App Card eliminates the need for a linked savings account or credit check, making it accessible to a wide range of users.

One of the standout Cash App Card benefits is the ability to direct deposit your paycheck up to two days early—a feature that rivals services like Venmo and PayPal. This is especially useful for freelancers or gig workers who rely on timely payments. You can also split bills with friends using peer-to-peer payments, withdraw cash from ATMs (with a small fee for out-of-network machines), and even earn Boosts—instant discounts at popular retailers like Starbucks or Target. These Boosts are updated regularly, adding extra value to everyday purchases.

Security is another major advantage. The card supports fraud prevention measures like instant transaction notifications, the ability to freeze/unfreeze the card via the app, and PIN or fingerprint authentication. Compared to competitors like Zelle or Google Pay, Cash App provides more granular control over your spending. For cryptocurrency enthusiasts, the card also allows you to spend Bitcoin directly from your balance (converted to USD at the point of sale), a feature that sets it apart from Apple Pay and other mobile payment platforms.

For investors, the Cash App Card integrates smoothly with Cash App Investing LLC, letting you use your balance to buy stocks or Bitcoin with as little as $1. This makes stock investing more accessible than traditional brokerage accounts. Plus, the app’s tax filing tools help you track capital gains and losses, simplifying your financial management.

Here’s a quick breakdown of key features:

- No monthly fees: Unlike some financial services, the Cash App Card doesn’t charge maintenance fees.

- Customization: Personalize your card with unique designs or colors (for a small fee).

- Instant transfers: Move money to your card instantly for a 1.5% fee, or wait 1-3 days for free.

- Square Point of Sale compatibility: Use your card at merchants that accept Square Cash, often with cashback rewards.

Whether you’re splitting rent with roommates, investing in cryptocurrency, or just looking for a smarter way to manage daily spending, the Cash App Card delivers a modern alternative to traditional mobile banking. Its combination of money transfer ease, stock trading integration, and bitcoin investment options makes it a must-have for digitally savvy users in 2025.

Professional illustration about Zelle

Cash App Investing Features

Cash App Investing Features: A Comprehensive Guide for 2025

Cash App, developed by Block, Inc. (formerly Square), has evolved beyond simple peer-to-peer payments into a robust financial services platform, with investing being one of its standout features. Unlike competitors like Venmo, PayPal, or Zelle, which focus primarily on money transfer, Cash App offers stock trading, Bitcoin investment, and even tax filing integrations—making it a versatile digital wallet for users looking to grow their money.

Cash App Investing LLC provides an intuitive interface for buying and selling stocks with as little as $1, thanks to fractional shares. This feature is perfect for beginners who want to dip their toes into stock investing without committing large sums. For example, you can invest in companies like Apple or Tesla with spare change from your direct deposit or peer-to-peer payments. The app also offers real-time market data and customizable alerts, ensuring you stay informed about your portfolio. Compared to traditional brokers, Cash App’s zero-commission model (similar to Square Point of Sale’s transparent pricing) makes it a cost-effective choice.

For those interested in Bitcoin trading, Cash App simplifies the process. You can buy, sell, or hold Bitcoin directly within the app, with the option to automatically invest a percentage of your direct deposit into cryptocurrency. The platform also supports Bitcoin withdrawals to external wallets, giving users full control over their assets. While Google Pay and Apple Pay focus on mobile payments, Cash App’s integration of cryptocurrency sets it apart as a hybrid mobile banking and investing tool. However, users should be aware of volatility and enable fraud prevention features like two-factor authentication.

Cash App Taxes (formerly Credit Karma Tax) is another standout feature, offering free tax filing for users. This seamlessly integrates with your stock investment and Bitcoin investment activity, automatically importing relevant tax forms like 1099-B for capital gains. For frequent traders, this eliminates the hassle of manual entry and reduces errors. Additionally, the debit card (Cash Card) rounds up purchases to invest the spare change—a clever way to build a savings account or portfolio over time.

With the rise of mobile payment scams, Cash App prioritizes security. Features like biometric login, transaction notifications, and the ability to disable the debit card instantly add layers of protection. Unlike Square Cash, which is more merchant-focused, Cash App’s investing features come with FDIC insurance for cash balances and SIPC protection for stocks, ensuring your assets are safeguarded.

- Use fractional shares to diversify your portfolio affordably.

- Set up recurring Bitcoin purchases to dollar-cost-average into cryptocurrency.

- Link your direct deposit to automate investments from your paycheck.

- Enable fraud prevention tools to secure your account.

Whether you’re a casual investor or exploring cryptocurrency, Cash App’s investing features provide a user-friendly gateway to growing wealth—all within the same app you use for peer-to-peer payments. In 2025, it remains a top contender against PayPal and Venmo, blending convenience with advanced financial services.

Professional illustration about Google

Cash App Bitcoin Trading

Cash App Bitcoin Trading has become one of the most accessible ways for everyday users to buy, sell, and hold Bitcoin, thanks to its seamless integration with Block, Inc.'s popular digital wallet. Unlike traditional cryptocurrency exchanges that require complex setups, Cash App simplifies Bitcoin investment with an intuitive interface, making it ideal for beginners. Users can start with as little as $1, and transactions settle instantly—no waiting for bank transfers or lengthy verification processes.

One standout feature is Cash App Investing LLC, which allows users to trade Bitcoin alongside stocks, blending peer-to-peer payments with stock investing in a single platform. This dual functionality sets it apart from competitors like Venmo, PayPal, or Zelle, which focus solely on money transfers. For those already using Square Point of Sale or Square Cash for business, integrating Bitcoin trading adds another layer of financial flexibility.

Security is a top priority, with fraud prevention measures like two-factor authentication and instant transaction alerts. Cash App also provides a debit card (the Cash Card) linked to your Bitcoin balance, letting you spend cryptocurrency anywhere major cards are accepted—a feature not commonly found with Google Pay or Apple Pay. However, users should be aware of volatility; Bitcoin prices can swing dramatically, so it’s wise to start small and diversify investments.

Tax filing is another critical consideration. Cash App generates IRS Form 1099-B for Bitcoin sales, simplifying tax filing for U.S. users. Compared to mobile banking apps that don’t support cryptocurrency, this makes Cash App a more comprehensive tool for managing both traditional and digital assets.

For those looking to grow their holdings, Cash App offers direct deposit into a savings account (powered by partner banks), letting users earn interest on idle cash before converting it to Bitcoin. The app also supports recurring Bitcoin purchases, automating bitcoin trading for long-term investors.

Here’s a pro tip: If you’re new to cryptocurrency, use Cash App’s price alerts to track Bitcoin trends. Combine this with their stock investment options to balance risk across asset classes. While competitors like Venmo and PayPal are catching up with crypto features, Cash App remains a leader due to its all-in-one financial services approach.

Finally, remember that peer-to-peer payments and Bitcoin trading are subject to fees. Cash App charges a variable fee for Bitcoin transactions (typically 1–3%), which is competitive but worth factoring into your strategy. Whether you’re using it for everyday money transfer or building a crypto portfolio, Cash App’s blend of simplicity and functionality makes it a top choice in 2025.

Professional illustration about Apple

Cash App Security Tips

Cash App Security Tips: How to Protect Your Digital Wallet in 2025

With over 50 million active users, Cash App (owned by Block, Inc.) has become one of the most popular peer-to-peer payment platforms, rivaling Venmo, Zelle, and Google Pay. However, its convenience also makes it a target for scams and fraud. Here’s how to secure your account and transactions in 2025.

One of the simplest yet most effective ways to protect your Cash App account is by enabling 2FA. This adds an extra layer of security beyond just a password, requiring a verification code sent to your phone or email. Without 2FA, hackers can easily gain access if they obtain your login credentials.

Avoid reusing passwords from other platforms like PayPal or Apple Pay. Instead, create a complex password with a mix of uppercase letters, numbers, and symbols. Consider using a password manager to store your credentials securely.

Scammers often impersonate Cash App support via fake emails, texts, or social media messages. Block, Inc. will never ask for your password, PIN, or debit card details. If you receive a suspicious message, report it immediately and never click on unfamiliar links.

Check your Cash App activity frequently for unauthorized money transfers or Bitcoin trading. If you spot anything unusual, freeze your Cash App debit card and contact support right away. Early detection can prevent bigger losses.

Unlike Square Point of Sale or Square Cash, which are often used for business transactions, Cash App is mainly for personal peer-to-peer payments. Only send money to people you know, and double-check recipient details before confirming.

If you use direct deposit or link a savings account, ensure your bank has strong fraud prevention measures. Avoid storing large sums in your Cash App digital wallet—transfer funds to your bank for added security.

Public networks are hotspots for hackers. Always use a secure, private connection when accessing Cash App, especially for Bitcoin investment or stock trading through Cash App Investing LLC. A VPN adds an extra layer of protection.

Since Cash App is a mobile payment app, losing your phone could mean losing access to your funds. Set up biometric authentication (fingerprint or face ID) and a strong passcode to prevent unauthorized access.

Cash App now offers stock investing and cryptocurrency trading, but these come with risks. Only invest what you can afford to lose, and never share your portfolio details with strangers promising "guaranteed returns."

Block, Inc. regularly releases security patches. Always update Cash App to the latest version to protect against vulnerabilities. Outdated apps are easier targets for exploits.

Take advantage of built-in tools like transaction notifications and the ability to disable your Cash App debit card if it’s lost or stolen. These small steps can make a big difference in fraud prevention.

By following these tips, you can enjoy the convenience of Cash App while minimizing risks. Whether you’re splitting bills, trading Bitcoin, or filing taxes through Cash App, staying vigilant is key to keeping your money safe in 2025.

Professional illustration about Bitcoin

Cash App Fees Explained

Cash App Fees Explained

Understanding the fee structure of Cash App is crucial for anyone using this digital wallet for peer-to-peer payments, Bitcoin trading, or stock investing. Developed by Block, Inc. (formerly Square), Cash App offers a range of financial services, but some transactions come with costs. Here’s a detailed breakdown of what you can expect in 2025.

Standard Transfers and Instant Deposits

Cash App allows free money transfers to other users, but there’s a catch: if you opt for an instant deposit to your debit card or linked bank account, you’ll pay a fee of 0.5% to 1.75% (minimum $0.25). For example, transferring $500 instantly could cost up to $8.75. Standard transfers (1–3 business days) are free, making them a smarter choice if you’re not in a hurry. Compared to competitors like Venmo or Zelle, which offer free instant transfers to eligible banks, Cash App’s fees are competitive but worth considering if speed is a priority.

Cash App Card and ATM Withdrawals

The Cash App debit card (powered by Visa) is free to order, but ATM withdrawals come with a $2.50 fee unless you meet certain conditions. Cash App reimburses up to $7 in ATM fees per month if you receive at least $300 in direct deposits monthly. This perk is similar to Apple Pay’s Cash Card or Google Pay’s partnered accounts, though policies vary by provider. Always check your mobile banking app for nearby in-network ATMs to avoid extra charges.

Bitcoin and Stock Trading Fees

For Bitcoin investment, Cash App charges a variable fee based on market conditions, typically ranging from 1% to 4% per transaction. This is higher than dedicated cryptocurrency exchanges but balances convenience for casual traders. Stock trading through Cash App Investing LLC is commission-free, but spreads (the difference between buy/sell prices) may apply. For active traders, platforms like Square Point of Sale or PayPal might offer lower costs for larger volumes.

Business and Tax Considerations

Businesses using Cash App for Square Cash payments pay 2.75% per swipe for in-person transactions and 2.9% + $0.30 for online invoices. Personal users don’t face these fees, but be mindful of tax filing requirements—the IRS requires reporting for Bitcoin sales or stock investment profits over $600. Cash App provides 1099-B forms for stocks and 1099-K for business transactions, streamlining fraud prevention and compliance.

Savings and Cash App’s Future

While Cash App lacks a traditional savings account, its “Savings” feature (launched in late 2024) offers APY on idle balances, competing with mobile payment giants. Fees here are minimal, but always compare rates with other financial services providers. As Block, Inc. expands, expect fee structures to evolve, especially for peer-to-peer payments and Bitcoin trading. Staying updated ensures you’re not overpaying for convenience.

Pro tip: Enable fraud prevention alerts in settings to avoid unauthorized charges, and review fees annually—Cash App occasionally adjusts rates based on market trends. Whether you’re splitting bills or diving into cryptocurrency, knowing these details helps maximize your money’s potential.

Professional illustration about Digital

Cash App vs Venmo 2025

When comparing Cash App and Venmo in 2025, it’s clear both platforms have evolved to offer robust peer-to-peer payment solutions, but they cater to slightly different audiences with unique features. Cash App, owned by Block, Inc. (formerly Square), has expanded beyond simple money transfers to become a full-fledged digital wallet with stock trading, Bitcoin investment, and even tax filing capabilities through partnerships like Cash App Investing LLC. On the other hand, Venmo, backed by PayPal, remains a social-heavy platform ideal for splitting bills or paying friends, with added perks like a Venmo debit card and direct deposit.

One standout difference is investing. While Venmo allows users to buy and sell cryptocurrencies, Cash App goes further by offering stock investing in addition to Bitcoin trading, making it a better choice for those looking to grow their portfolio. Cash App also integrates seamlessly with Square Point of Sale, giving small businesses an edge in accepting payments. Venmo, however, shines in social features—think payment notes with emojis and a feed that lets you share transactions (privately or publicly).

For fraud prevention, both apps use advanced security measures like encryption and mobile banking alerts, but Cash App’s savings account feature (with optional high-yield interest) adds another layer of financial management. Venmo counters with its PayPal backbone, which offers purchase protection on qualified transactions—a perk Cash App lacks.

When it comes to money transfer speed, both support instant transfers for a fee, but Zelle (bank-backed) and Google Pay/Apple Pay (device-centric) often outpace them for no-cost transactions. That said, Cash App and Venmo dominate in usability for younger users, with Venmo’s interface feeling more intuitive for casual payments and Cash App appealing to those dabbling in cryptocurrency or stock investment.

Here’s a quick breakdown of key differences:

- Fees: Cash App charges 1.5%–3% for instant transfers; Venmo fees are similar but waive them for certain direct deposit users.

- Bitcoin: Cash App supports Bitcoin buys/sells with lower fees than Venmo’s crypto feature.

- Business Use: Cash App’s Square Cash integration is unbeatable for merchants; Venmo leans toward personal use.

- Social: Venmo’s feed is fun for friends; Cash App keeps things minimalist.

Ultimately, your choice depends on needs. If you’re into financial services beyond payments (like stock trading or tax filing), Cash App is the winner. For a socially driven peer-to-peer payment experience, Venmo holds its ground. Both are strong contenders in the mobile payment space, but their 2025 updates show they’re targeting different niches.

Professional illustration about payment

Cash App Customer Support

Cash App Customer Support: How to Get Help Fast in 2025

If you're using Cash App for peer-to-peer payments, Bitcoin trading, or even stock investing, knowing how to reach customer support is crucial. Unlike traditional banks or competitors like PayPal or Zelle, Cash App (owned by Block, Inc.) operates primarily through its mobile app, which means support options are slightly different. Here’s how to navigate Cash App’s customer service in 2025, along with tips to resolve common issues like fraud prevention, direct deposit delays, or problems with your Cash App debit card.

How to Contact Cash App Support

The fastest way to get help is through the app itself. Open Cash App, tap your profile icon, scroll down to "Support," and describe your issue. The system uses AI to suggest solutions, but if that doesn’t work, you can request a callback or live chat. For urgent matters—like unauthorized money transfers or a locked account—this is your best bet. Unlike Venmo or Google Pay, Cash App doesn’t offer phone support unless you’re already in an active chat thread, so avoid searching for a customer service number (many are scams).

Common Issues and Fixes

- Fraud Prevention: If you suspect unauthorized activity, immediately disable your Cash App debit card in the app and report the transaction. Cash App’s financial services team typically responds within 24 hours.

- Direct Deposit Delays: In 2025, delays can happen if banking details (like your account/routing numbers) are entered incorrectly. Double-check these in the "Banking" tab.

- Bitcoin or Stock Trading Problems: For issues with Cash App Investing LLC (the arm handling stock investment and cryptocurrency), support may escalate your case to a specialist. Keep records of trade confirmations.

When to Escalate

If support isn’t resolving your issue, try reaching out to Block, Inc. via their official X (formerly Twitter) account (@CashSupport). Public tweets often get faster responses. For legal or regulatory concerns (e.g., tax filing disputes related to Bitcoin investment), you may need to consult Cash App’s legal team or file a complaint with the CFPB.

Pro Tips

- Always enable two-factor authentication to avoid mobile payment scams.

- Cash App support won’t ask for your PIN or password—beware of imposters.

- For peer-to-peer payments sent to the wrong person, act fast: cancellations are only possible if the recipient hasn’t accepted the funds.

While Cash App’s support isn’t as robust as Apple Pay’s or Square Point of Sale’s dedicated teams, knowing these steps can save you time and stress. Keep screenshots of transactions and support chats for reference—you’ll thank yourself later.

Professional illustration about trading

Cash App Direct Deposit

Cash App Direct Deposit: A Seamless Way to Get Paid Faster

Cash App’s direct deposit feature is a game-changer for users who want to skip traditional banking hassles. Operated by Block, Inc. (formerly Square), this service lets you receive paychecks, tax refunds, or government benefits up to two days early—without needing a brick-and-mortar bank. All you need is a Cash App debit card (officially called the Cash Card) linked to your account. Once you share your account and routing numbers with your employer or benefits provider, funds land directly in your digital wallet, ready to spend, invest, or transfer.

Compared to competitors like Venmo or Zelle, Cash App stands out by offering peer-to-peer payment flexibility alongside direct deposits. For freelancers or gig workers, this means no more waiting for paper checks or dealing with third-party delays. Plus, Cash App doesn’t charge monthly fees for direct deposit, unlike some traditional banks. Funds are FDIC-insured through partner banks, adding a layer of fraud prevention and security.

Here’s where it gets even better: Cash App integrates with Bitcoin trading and stock investing via Cash App Investing LLC. If you’re into cryptocurrency or want to grow your savings, you can automatically allocate a percentage of your direct deposit into Bitcoin or stocks like Apple or Tesla. This hybrid approach blends mobile banking with investment opportunities, something PayPal or Google Pay doesn’t offer natively.

A few pro tips:

- Double-check your account details: Ensure your employer uses the correct routing number (provided in-app) to avoid delays.

- Set up notifications: Cash App alerts you the moment funds hit your account, so you can track deposits in real time.

- Combine with Cash App Boost: Use your direct deposit funds to unlock instant discounts at retailers like Starbucks or Whole Foods when you pay with your Cash Card.

One caveat? Daily and monthly deposit limits apply, so high-volume users might need a backup for larger transactions. But for everyday users, Cash App’s direct deposit is a sleek, modern alternative to clunky mobile payment systems—especially if you’re already using its money transfer or Square Point of Sale features for side hustles. Whether you’re splitting rent with roommates via peer-to-peer payments or diving into bitcoin investment, this feature keeps your finances agile.

Fun fact: Cash App’s tax filing tools let you automatically set aside a portion of your direct deposit for estimated taxes—perfect for freelancers navigating IRS deadlines. Now that’s financial multitasking.

Professional illustration about filing

Cash App Boost Rewards

Cash App Boost Rewards is one of the most underrated perks of using this popular mobile payment platform. Unlike traditional debit card rewards that offer generic cashback, Cash App’s Boost program delivers instant, targeted discounts at specific merchants—think 10% off at Coffee Shop X or $5 off at Grocery Store Y. These Boosts are dynamically updated and can be activated with a single tap in the app, making them a seamless way to save money daily. What sets it apart from competitors like Venmo or Zelle is the sheer variety of Boosts, ranging from local businesses to major chains. For example, users might find a 15% discount at a participating pizza place or even a special Boost for Bitcoin purchases during promotional periods.

The mechanics are simple but powerful: link your Cash App debit card (issued by Block, Inc.) to your account, browse available Boasts in the app, and activate the ones that suit your spending habits. Each Boost has a limited number of redemptions or a time window, so timing matters. Unlike Google Pay or Apple Pay, which focus more on contactless payments, Cash App Boosts integrate savings directly into your everyday transactions. For frequent users, this can add up to hundreds of dollars in annual savings—especially when stacked with other features like direct deposit or stock investing through Cash App Investing LLC.

Security is also a priority. Fraud prevention measures ensure Boosts can’t be exploited, and transactions are protected with the same encryption standards used for peer-to-peer payments and bitcoin trading on the platform. While PayPal might offer broader merchant acceptance, Cash App’s Boosts provide a more personalized and financially rewarding experience. For budget-conscious users, this feature alone can justify choosing Cash App over alternatives like Square Point of Sale or traditional banking apps. Pro tip: Combine Boosts with mobile banking features like savings account round-ups to maximize your money’s potential.

For those diving deeper into financial services, Boosts can even complement stock investment strategies. Imagine using a 5% cashback Boost at a retailer, then funneling those savings into fractional shares via Cash App’s investing arm. It’s a micro-investing hack that turns everyday spending into portfolio growth. The program’s flexibility—whether you’re grabbing lunch or paying bills—makes it a standout in the crowded digital wallet space. Just remember: Boosts are location-sensitive, so urban users often see more options than those in rural areas. If you’re not using them yet, you’re leaving money on the table.

Professional illustration about Investing

Cash App Tax Features

Tax season can be stressful, but Cash App (owned by Block, Inc.) has streamlined the process with its tax filing features, making it easier for users to handle their finances in one place. Whether you’re freelancing, investing in Bitcoin, or trading stocks through Cash App Investing LLC, the platform’s integrated tax tools help you stay organized and compliant. Here’s how Cash App stands out in 2025 compared to competitors like Venmo, PayPal, or Zelle, which focus primarily on peer-to-peer payments without built-in tax support.

One of the standout features is automatic tax form generation. If you’ve earned income through direct deposit, stock trading, or Bitcoin investments on Cash App, the platform generates IRS forms like the 1099-B or 1099-K seamlessly. For example, if you sold cryptocurrency or stocks, Cash App compiles your gains and losses into a downloadable document, eliminating the need for manual calculations. This is a game-changer compared to Google Pay or Apple Pay, which don’t offer similar financial services for tax preparation.

Cash App also simplifies tax filing for freelancers and small business owners who use Square Point of Sale or Square Cash. The app syncs transaction history, so you can categorize deductions (like equipment or mileage) directly within the platform. In 2025, Cash App even introduced a savings account feature, allowing users to set aside money for tax payments—helping avoid last-minute scrambles. Competitors like PayPal lack this level of integration, forcing users to rely on third-party apps for tax filing.

For fraud prevention, Cash App’s tax features include real-time alerts for discrepancies in reported earnings or suspicious activity. If you’ve ever worried about errors on your 1099 forms, Cash App’s mobile banking interface lets you dispute inaccuracies with a few taps. Meanwhile, platforms like Zelle or Venmo don’t provide tax dispute resolution, leaving users to navigate IRS communications alone.

Another advantage is Cash App’s Bitcoin trading tax reporting. In 2025, the IRS requires detailed records of cryptocurrency transactions, and Cash App automatically tracks your cost basis and sale dates—critical for calculating capital gains. Compare this to managing Bitcoin investments on external exchanges, where you’d need to manually export data into tax software. Even mobile payment giants like Apple Pay haven’t bridged this gap, making Cash App a preferred choice for crypto enthusiasts.

For beginners, Cash App’s investing dashboard includes a layman’s breakdown of tax implications. For instance, if you bought $500 of stock and sold it for $700, the app highlights your $200 taxable gain and estimates how much to set aside. This transparency is rare among peer-to-peer payment apps, which often treat stock investment as an afterthought.

Pro tip: If you use Cash App’s debit card for business expenses, the app can tag those transactions as write-offs. Say you bought a laptop for freelance work—snap a photo of the receipt, and Cash App stores it under "Tax Deductions." No more shoeboxes full of receipts! Meanwhile, money transfer apps like Zelle offer no such organizational tools.

In 2025, Cash App’s tax features are especially valuable for gig workers. If you drive for rideshares or deliver food, the app’s mileage tracker logs trips automatically, syncing with your tax forms. Competitors like Google Pay or Venmo don’t provide this niche functionality, leaving gig workers to track expenses manually.

Finally, Cash App’s fraud prevention extends to tax-related scams. The app flags phishing emails pretending to be from the IRS—a common threat during tax season. By contrast, mobile payment platforms without dedicated financial services lack these safeguards.

Whether you’re a freelancer, investor, or casual user, Cash App’s tax filing tools save time and reduce errors. From Bitcoin reporting to stock trading summaries, it’s a one-stop shop for tax-ready finances—something PayPal, Venmo, and Apple Pay still can’t match in 2025.