Professional illustration about Bitcoin

Coinbase Basics 2025

Coinbase Basics 2025

Coinbase remains one of the most trusted and widely used cryptocurrency exchanges in 2025, offering a seamless platform for buying, selling, and managing digital assets like Bitcoin, Ethereum, Dogecoin, and Solana. Founded by Brian Armstrong in 2012, Coinbase Global, Inc. has evolved into a powerhouse in the blockchain industry, with its stock (COIN) now included in the S&P 500, reflecting its growing influence in traditional finance. Whether you're a beginner or an experienced trader, understanding the basics of Coinbase is essential for navigating the crypto trading landscape.

One of the core features of Coinbase is its user-friendly interface, which simplifies buying and selling crypto for newcomers. The platform supports a wide range of crypto assets, including stablecoins like Tether, making it a versatile choice for investors. In 2025, Coinbase has further enhanced its security measures, offering crypto custody solutions to protect users' funds. The Coinbase Wallet also provides a secure way to store digital assets independently, giving users full control over their private keys—a key aspect of decentralized finance (DeFi).

For institutional investors and high-volume traders, Coinbase Prime delivers advanced tools for crypto trading, including deep liquidity and robust analytics. Meanwhile, Coinbase One, the subscription-based service, offers perks like zero trading fees and priority customer support, catering to frequent traders. The platform's trading volume continues to grow, driven by increasing adoption of blockchain technology and the expansion of crypto payments into mainstream commerce.

Coinbase has also integrated crypto rewards programs, allowing users to earn interest on their holdings—a feature that’s particularly appealing in 2025 as more people explore passive income opportunities in the cryptocurrency space. With its commitment to regulatory compliance and innovation, Coinbase Global Inc. stands out as a leader in the industry, bridging the gap between traditional finance and the future of digital assets. Whether you're looking to trade, invest, or simply learn about crypto, Coinbase provides the tools and resources to get started.

In summary, Coinbase in 2025 is more than just an exchange—it’s a comprehensive ecosystem for crypto assets, backed by cutting-edge technology and a reputation for reliability. From the simplicity of the Coinbase Wallet to the sophistication of Coinbase Prime, the platform caters to all levels of expertise, ensuring it remains a top choice for millions of users worldwide.

Professional illustration about Ethereum

Buy Crypto on Coinbase

Buying cryptocurrency on Coinbase is one of the easiest ways to enter the world of digital assets, whether you're a beginner or an experienced trader. As one of the largest cryptocurrency exchanges globally, Coinbase offers a user-friendly platform to buy and sell crypto like Bitcoin, Ethereum, Dogecoin, Solana, and stablecoins such as Tether. Founded by Brian Armstrong, Coinbase Global, Inc. (ticker: COIN) has become a household name in blockchain technology, even earning a spot in the S&P 500—a testament to its legitimacy in the decentralized finance space.

To get started, you'll need to create an account on Coinbase, which involves verifying your identity to comply with regulations—a standard practice for reputable exchanges. Once set up, you can fund your account using a bank transfer, debit card, or even PayPal in some regions. The platform’s intuitive interface makes it simple to navigate crypto trading, with real-time price charts and tools to track trading volume and market cap. For those who prefer a more hands-off approach, Coinbase also offers automated recurring purchases, allowing you to buy crypto at regular intervals and dollar-cost average into the market.

If security is a concern, Coinbase provides robust crypto custody solutions. While your assets are stored on the exchange by default, you can transfer them to the Coinbase Wallet—a non-custodial crypto wallet that gives you full control over your private keys. For institutional investors or high-net-worth individuals, Coinbase Prime offers advanced trading features, including over-the-counter (OTC) trades and dedicated account management. Meanwhile, Coinbase One, the platform’s subscription service, unlocks perks like zero trading fees and priority customer support, making it ideal for active traders.

One of the standout features of Coinbase is its educational program, Coinbase Earn, which rewards users with crypto rewards for learning about different crypto assets. For example, you might earn a few dollars’ worth of Ethereum by watching a short video on blockchain basics—a great way to dip your toes into the ecosystem. Additionally, Coinbase supports crypto payments, allowing merchants and users to transact seamlessly with supported cryptocurrencies.

When comparing Coinbase to other exchanges, its regulatory compliance and transparency set it apart. As a publicly traded company, Coinbase Global adheres to strict financial reporting standards, which can provide peace of mind for investors wary of less-regulated platforms. However, keep in mind that trading fees on Coinbase can be higher than on some competitors, especially for smaller transactions. To mitigate this, consider using Coinbase Advanced Trade, which offers lower fees for limit orders and more sophisticated charting tools.

Whether you're looking to invest in Bitcoin as a long-term store of value or trade altcoins like Solana for short-term gains, Coinbase provides the infrastructure to do so securely. Its integration with decentralized finance protocols and support for staking further enhance its appeal for those looking to grow their digital assets beyond simple trading. With continuous updates and new features rolling out in 2025, Coinbase remains a top choice for anyone entering the cryptocurrency market.

Professional illustration about Coinbase

Coinbase Fees Explained

Coinbase Fees Explained

Understanding Coinbase’s fee structure is critical for anyone trading Bitcoin, Ethereum, or other cryptocurrencies on the platform. As one of the largest cryptocurrency exchanges globally, Coinbase Global, Inc. offers multiple services, including Coinbase Wallet, Coinbase Prime, and Coinbase One, each with its own pricing model. Here’s a breakdown of what you need to know in 2025.

Trading Fees

Coinbase charges variable fees based on factors like trading volume, payment method, and whether you’re a maker or taker. For retail users, the standard fee ranges from 0.50% to 2.00% per transaction, depending on the digital asset being traded. For example, buying Dogecoin or Solana with a debit card typically incurs higher fees (around 2.00%) compared to ACH bank transfers (1.49%). High-volume traders using Coinbase Prime enjoy reduced fees, sometimes as low as 0.10%, making it a preferred choice for institutional investors.

Spread Fees

In addition to trading fees, Coinbase applies a spread markup of about 0.50% for crypto trading. This means the price you see isn’t always the price you pay—especially during periods of high volatility. For instance, if Bitcoin’s price surges, the spread might widen, increasing your effective cost.

Subscription Fees

Coinbase One, the platform’s subscription service ($29.99/month in 2025), eliminates trading fees for members and offers perks like enhanced crypto rewards and priority support. This can be a cost-effective option for frequent traders, especially those dealing with assets like Ethereum or Tether regularly.

Other Fees

- Crypto custody: Storing assets in Coinbase Wallet is free, but transferring them to external wallets incurs network fees (e.g., blockchain gas fees for Ethereum).

- Crypto payments: Using Coinbase’s commerce tools for payments may involve additional processing fees, though these are often lower than traditional payment gateways.

- Withdrawals: Cashing out to a bank account or PayPal usually costs a flat fee (e.g., $1.99 for instant USD withdrawals).

How to Minimize Fees

1. Use limit orders: These often qualify for lower maker fees compared to market orders.

2. Leverage Coinbase Advanced: The platform’s pro-tier interface offers reduced fees for active traders.

3. Bundle transactions: Larger trades can sometimes negotiate better rates, especially on Coinbase Prime.

4. Monitor promotions: Coinbase occasionally waives fees for specific crypto assets like Solana or Dogecoin during promotional periods.

The Bigger Picture

Under CEO Brian Armstrong, Coinbase has streamlined its fee models to compete with rivals, but costs remain higher than some decentralized exchanges. However, the trade-off is regulatory compliance and security—key reasons why Coinbase Global Inc. (ticker: COIN) remains a staple in the S&P 500 and a trusted name in decentralized finance. Whether you’re a casual investor or a high-net-worth trader, knowing these fee nuances ensures you maximize your crypto assets’ potential.

Professional illustration about Armstrong

Coinbase Pro Features

Coinbase Pro Features

Coinbase Pro is the advanced trading platform offered by Coinbase Global, Inc., designed for serious crypto trading enthusiasts and institutional investors. Unlike the standard Coinbase interface, Coinbase Pro provides lower fees, advanced charting tools, and deeper liquidity for digital assets like Bitcoin, Ethereum, Solana, and Dogecoin. As of 2025, the platform remains a top choice for traders looking to maximize their trading volume while minimizing costs.

One of the standout features of Coinbase Pro is its fee structure, which is significantly cheaper than the retail version of Coinbase. Fees are based on a maker-taker model, rewarding liquidity providers with lower rates. For example, high-volume traders can enjoy fees as low as 0.05%, making it an attractive option for those executing large orders. Additionally, the platform supports crypto-to-crypto trading pairs, allowing users to swap assets like Ethereum for Solana without converting to fiat first.

The platform also excels in market data and analytics. Traders get access to real-time order books, candlestick charts, and historical price data—essential tools for making informed decisions. Coinbase Pro integrates seamlessly with Coinbase Wallet, enabling users to transfer funds between their trading and crypto wallet accounts effortlessly. For institutional clients, Coinbase Prime offers even more robust features, including crypto custody solutions and OTC trading desks.

Security is another major highlight. Coinbase Global Inc., under the leadership of Brian Armstrong, has built a reputation for prioritizing safety. The platform employs blockchain technology and cold storage for the majority of user funds, drastically reducing the risk of hacks. Furthermore, Coinbase Pro is compliant with U.S. regulations, adding an extra layer of trust for traders concerned about the volatile nature of cryptocurrency markets.

In 2025, Coinbase Pro continues to evolve, integrating decentralized finance (DeFi) capabilities and expanding its support for emerging crypto assets like Tether and Solana. The platform’s API also allows for automated trading strategies, appealing to algorithmic traders. With Coinbase Global, Inc. now part of the S&P 500, the company’s stock (COIN) reflects its growing influence in the cryptocurrency exchange space. Whether you’re a retail trader or a financial institution, Coinbase Pro delivers the tools needed to navigate the fast-paced world of crypto payments and investments.

For those looking to dive deeper, Coinbase One offers premium features like zero-fee trading and dedicated customer support, bridging the gap between casual and professional traders. The platform’s commitment to innovation ensures it remains competitive in an industry where blockchain advancements happen daily. If you’re serious about buying and selling crypto, Coinbase Pro is a must-consider platform in 2025.

Professional illustration about COIN

Coinbase Wallet Guide

Coinbase Wallet Guide: The Ultimate Tool for Managing Your Crypto Assets

If you're diving into the world of cryptocurrency, the Coinbase Wallet is one of the most user-friendly and secure options for storing, trading, and managing your digital assets. Unlike the Coinbase exchange, which acts as a custodial platform, the Coinbase Wallet is a non-custodial crypto wallet, meaning you have full control over your private keys—a critical feature for those who prioritize decentralized finance (DeFi) principles. Whether you're holding Bitcoin, Ethereum, Dogecoin, or newer assets like Solana, this wallet supports thousands of tokens and integrates seamlessly with blockchain technology.

Why Choose Coinbase Wallet?

One of the standout features of the Coinbase Wallet is its simplicity. Even beginners can easily buy and sell crypto, swap tokens, or explore DeFi applications without needing deep technical knowledge. The wallet also supports crypto payments, allowing users to send and receive funds with just a few taps. For those interested in crypto rewards, the wallet integrates with various staking and yield-farming platforms, making it a versatile tool for both passive income and active trading.

Security is another major advantage. While Coinbase Global, Inc. ensures robust protection for its exchange users, the Coinbase Wallet takes it a step further by letting you manage your own security. You can enable biometric authentication, multi-signature approvals, and even connect hardware wallets for added layers of protection. This makes it a preferred choice for traders who want to avoid the risks associated with centralized cryptocurrency exchanges.

Advanced Features for Seasoned Traders

For high-net-worth individuals or institutional investors, Coinbase Prime and Coinbase One offer enhanced trading tools and lower fees. However, the Coinbase Wallet remains a powerful standalone option for everyday users. It supports NFTs, interacts with DeFi protocols like Uniswap and Aave, and even allows you to explore the growing ecosystem of blockchain-based games.

The wallet’s integration with Coinbase Global Inc.’s broader ecosystem means you can easily move funds between the exchange and your wallet, optimizing your crypto trading strategy. For example, if you spot a surge in Ethereum or Solana on the exchange, you can quickly transfer assets to your wallet to participate in DeFi opportunities or long-term holdings.

Market Trends and Coinbase Wallet’s Role

As cryptocurrency gains mainstream adoption, Coinbase continues to innovate. Under the leadership of Brian Armstrong, the company has expanded its services to include crypto custody, institutional solutions, and even a spot in the S&P 500—a testament to its growing influence. The Coinbase Wallet plays a pivotal role in this expansion by bridging the gap between traditional finance and the blockchain world.

For traders keeping an eye on market cap and trading volume, the wallet provides real-time price tracking and portfolio management tools. Whether you’re hedging against market volatility or diversifying with stablecoins like Tether, the Coinbase Wallet offers the flexibility needed to navigate today’s fast-moving crypto assets landscape.

Final Tips for Maximizing Your Coinbase Wallet Experience

- Backup your recovery phrase securely: Losing access to your wallet means losing your funds forever.

- Explore DeFi integrations: Use the wallet’s built-in browser to access lending platforms, staking pools, and more.

- Monitor gas fees: When trading Ethereum or other blockchain assets, timing your transactions can save you money.

- Stay updated: Coinbase frequently rolls out new features, so keep an eye on announcements for enhancements like crypto rewards or new token support.

By leveraging the Coinbase Wallet, you’re not just storing cryptocurrency—you’re unlocking a gateway to the entire blockchain ecosystem. Whether you’re a casual investor or a serious trader, this tool provides the security, flexibility, and functionality needed to thrive in the digital assets space.

Professional illustration about Dogecoin

Coinbase Security Tips

Coinbase Security Tips: Protecting Your Crypto Assets in 2025

As one of the largest cryptocurrency exchanges in the world, Coinbase prioritizes security, but users must also take proactive steps to safeguard their digital assets. Whether you're trading Bitcoin, Ethereum, Dogecoin, or Solana, these security best practices will help you minimize risks.

The first line of defense is enabling 2FA on your Coinbase account. While SMS-based 2FA is better than nothing, opt for an authenticator app like Google Authenticator or Authy for stronger protection. Hackers often target phone numbers through SIM-swapping attacks, making app-based 2FA far more secure. Brian Armstrong, CEO of Coinbase Global, Inc., has repeatedly emphasized the importance of 2FA in preventing unauthorized access.

If you hold significant amounts of cryptocurrency, consider moving assets from Coinbase to a crypto wallet like Coinbase Wallet (a non-custodial option) or a hardware wallet for long-term storage. While Coinbase Prime and Coinbase One offer institutional-grade security, self-custody ensures you control your private keys—critical for decentralized finance (DeFi) users.

Phishing remains a top threat in crypto trading. Scammers impersonate Coinbase via fake emails or websites, tricking users into revealing login credentials. Always verify URLs (ensure it's coinbase.com) and never click on suspicious links. Coinbase Global Inc. will never ask for your password or 2FA codes via email.

Regularly review your Coinbase account for unusual transactions. If you notice unauthorized buy and sell crypto activity, lock your account immediately. Coinbase also offers withdrawal whitelisting, allowing only pre-approved wallet addresses to receive funds—a must for high-net-worth traders.

Don’t keep all your crypto assets in one place. Split holdings between Coinbase, Coinbase Wallet, and cold storage (like Ledger or Trezor). This strategy, known as "multi-sig" or crypto custody diversification, reduces single-point failure risks.

Coinbase frequently rolls out new security tools. In 2025, features like biometric logins and advanced blockchain technology monitoring help detect suspicious behavior. Subscribers to Coinbase One gain access to enhanced security alerts and priority support.

Public networks are hotspots for hackers. If you must access Coinbase on the go, use a VPN to encrypt your connection. This is especially crucial when trading high-market cap assets like Tether or Ethereum, where large transactions attract malicious actors.

Whether using Coinbase’s mobile app or a crypto wallet, always install the latest updates. Outdated software may contain vulnerabilities that hackers exploit. This applies to your device’s operating system as well.

As a publicly traded company (COIN on the S&P 500), Coinbase Global, Inc. adheres to strict financial regulations. However, crypto payments and rewards aren’t FDIC-insured like traditional bank deposits. Always research the latest compliance measures to understand your protections.

By following these Coinbase security tips, you can trade and store cryptocurrency with confidence. The crypto exchange landscape evolves rapidly, so staying informed is key to protecting your investments in 2025 and beyond.

Professional illustration about 未知實體

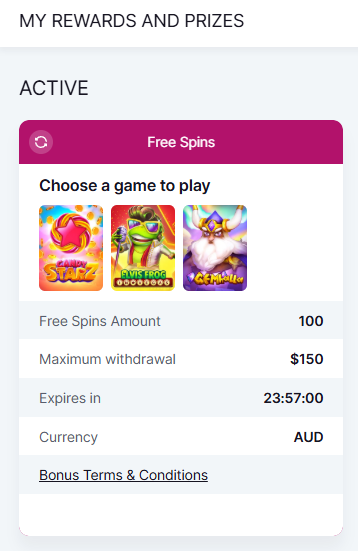

Coinbase Staking 2025

Coinbase Staking has solidified its position as a leading platform for earning passive income through cryptocurrency in 2025. With the rise of Ethereum 2.0 and the growing adoption of proof-of-stake (PoS) blockchains like Solana, staking has become a cornerstone of decentralized finance (DeFi). Coinbase, under the leadership of Brian Armstrong, has expanded its staking offerings to include not just Ethereum but also Bitcoin (via wrapped tokens), Dogecoin, and other high-yield assets. The platform’s user-friendly interface, combined with its crypto custody solutions, makes it a top choice for both beginners and seasoned investors looking to maximize their crypto rewards.

One of the standout features of Coinbase Staking 2025 is its integration with Coinbase Wallet and Coinbase Prime, allowing users to seamlessly manage their digital assets across multiple products. The staking rewards are competitive, often outperforming traditional savings accounts, with Ethereum staking APYs hovering around 5-7% and Solana offering even higher returns. For institutional investors, Coinbase Global, Inc. provides tailored staking solutions through Coinbase One, which includes advanced analytics and tax reporting tools.

The regulatory landscape in 2025 has also played a role in shaping Coinbase Staking. With clearer guidelines from the SEC and global regulators, staking has become more mainstream, attracting inflows from retail and institutional players alike. Coinbase’s compliance-first approach ensures that users can stake with confidence, knowing their assets are secure and backed by blockchain technology. Additionally, the platform’s trading volume and market cap growth reflect its dominance in the cryptocurrency exchange space, further bolstering its staking services.

For those new to staking, Coinbase offers educational resources to explain the process, from selecting assets to understanding slashing risks. The ability to buy and sell crypto directly within the staking interface adds convenience, while Tether (USDT) staking provides a stablecoin option for risk-averse users. As crypto payments gain traction, staking rewards can even be used to offset transaction fees, creating a seamless loop for active traders.

Looking ahead, Coinbase Staking is poised to integrate more blockchain networks, including emerging PoS projects, as the demand for crypto assets grows. Whether you’re a long-term holder or a DeFi enthusiast, staking on Coinbase in 2025 offers a reliable way to grow your portfolio while contributing to network security. With its robust infrastructure and commitment to innovation, Coinbase Global remains at the forefront of the staking revolution.

Professional illustration about Coinbase

Coinbase NFT Marketplace

Coinbase NFT Marketplace has emerged as a major player in the digital collectibles space, leveraging Coinbase's reputation as a trusted cryptocurrency exchange to attract both crypto enthusiasts and traditional collectors. Unlike other platforms that focus solely on Ethereum-based NFTs, Coinbase supports multiple blockchains, including Solana, making it a versatile hub for digital assets. The marketplace integrates seamlessly with Coinbase Wallet, allowing users to buy, sell, and store NFTs with ease—a feature that sets it apart from competitors. For traders, the platform offers low fees and high liquidity, thanks to Coinbase Global, Inc.'s massive user base and trading volume.

One standout feature is its focus on accessibility. Brian Armstrong, CEO of Coinbase, has emphasized making NFTs more approachable for beginners, with intuitive tools like batch listings and gas-free trading (for certain transactions). This aligns with Coinbase's broader mission to simplify crypto trading for mainstream audiences. The marketplace also supports crypto payments in Bitcoin, Ethereum, and even Dogecoin, catering to a wide range of preferences. For institutional investors, Coinbase Prime offers advanced custody solutions, ensuring secure storage for high-value NFTs and other crypto assets.

From a market perspective, Coinbase NFT Marketplace benefits from the growing demand for blockchain technology in art, gaming, and entertainment. Its parent company, Coinbase Global, is publicly traded (NASDAQ: COIN) and included in the S&P 500, adding a layer of credibility rarely seen in the NFT space. The platform also taps into trends like decentralized finance (DeFi) by enabling NFT-backed loans and fractional ownership. While competitors like OpenSea dominate in sheer volume, Coinbase’s emphasis on compliance and user security—backed by its crypto custody expertise—makes it a safer choice for cautious investors.

For creators, the marketplace offers robust monetization tools, including royalties and customizable smart contracts. This has attracted high-profile artists and brands looking to mint NFTs without navigating the complexities of blockchain infrastructure. Additionally, Coinbase One subscribers enjoy perks like zero trading fees and priority support, further incentivizing adoption. As the NFT market evolves, Coinbase NFT Marketplace is poised to grow alongside emerging trends, from generative art to virtual real estate, solidifying its role as a bridge between traditional finance and the digital assets revolution.

Professional illustration about Coinbase

Coinbase Debit Card

The Coinbase Debit Card is one of the most seamless ways to spend your crypto assets in everyday life, bridging the gap between digital assets and traditional finance. Launched by Coinbase Global, Inc., this Visa-powered card allows users to convert Bitcoin, Ethereum, Dogecoin, and other supported cryptocurrencies into fiat currency at the point of sale—with no additional fees for the conversion. Whether you're buying groceries, paying bills, or shopping online, the card automatically deducts funds from your Coinbase Wallet or linked account, making crypto payments as easy as swiping a traditional debit card.

One of the standout features of the Coinbase Debit Card is its crypto rewards program. Users earn up to 4% back in crypto assets like Solana or Tether on every purchase, depending on the card tier and holdings. For frequent spenders, this creates a passive income stream while encouraging broader adoption of blockchain technology in daily transactions. The card also integrates seamlessly with Coinbase Prime and Coinbase One, offering institutional-grade security and premium perks for high-volume traders.

From a financial perspective, the card’s performance aligns with Coinbase Global Inc's stock (COIN), which has seen increased investor confidence as the company expands its decentralized finance offerings. Analysts tracking the S&P 500 have noted that Coinbase's diversification into tangible products like the debit card strengthens its position in the cryptocurrency exchange market. CEO Brian Armstrong has emphasized the card’s role in democratizing access to crypto trading, particularly for users who prefer spending crypto over holding it long-term.

Security is another major advantage. The Coinbase Debit Card leverages crypto custody solutions to protect users’ funds, with instant transaction notifications and the ability to freeze the card via the Coinbase Wallet app. Unlike traditional banks, where chargebacks or fraud can take days to resolve, blockchain-powered transactions are irreversible, reducing fraud risk. For travelers, the card supports global payments in over 40 million locations, with real-time conversion rates that avoid the hidden fees often associated with forex transactions.

For those new to crypto payments, the card simplifies the process of buying and selling crypto without needing to manually cash out. For example, if you spend $100 at a retailer, the equivalent value in Ethereum is instantly converted from your wallet—no middleman required. This frictionless experience has driven adoption among millennials and Gen Z, who value both convenience and the ability to hodl while spending.

Critics argue that volatility in cryptocurrency prices could affect spending power, but Coinbase mitigates this by allowing users to peg purchases to stablecoins like Tether or USD Coin (USDC). Additionally, the card’s trading volume and market cap metrics are closely watched by analysts as indicators of mainstream crypto adoption. With Coinbase continuously adding support for new tokens and features, the debit card remains a forward-thinking tool for bridging digital assets with real-world utility.

Pro tips for maximizing the Coinbase Debit Card:

- Enable crypto rewards in the app to earn back on every purchase.

- Link the card to Coinbase One for reduced trading fees and enhanced customer support.

- Use it for recurring subscriptions to accumulate rewards over time.

- Monitor stock price trends of COIN to gauge market sentiment around Coinbase's innovations.

Whether you're a crypto enthusiast or just curious about blockchain-based spending, the Coinbase Debit Card offers a practical, rewarding, and secure way to integrate digital assets into your financial life. Its growing acceptance worldwide signals a shift toward a future where cryptocurrency isn’t just an investment—it’s a spendable currency.

Professional illustration about Coinbase

Coinbase Tax Reporting

Coinbase Tax Reporting: What You Need to Know in 2025

Navigating tax reporting for cryptocurrency transactions on Coinbase can be complex, but understanding the platform’s tools and IRS requirements is crucial. As one of the largest cryptocurrency exchanges, Coinbase offers resources like Coinbase Tax to simplify tracking gains, losses, and income from Bitcoin, Ethereum, Dogecoin, and other digital assets. Whether you’re a casual trader or a high-volume investor using Coinbase Prime, here’s how to stay compliant while maximizing deductions.

Key Tax Forms and Reporting Tools

Common Pitfalls and Pro Tips

- Tracking Cost Basis: Coinbase’s default method is FIFO (First-In-First-Out), but you can opt for specific identification (SpecID) if you’ve documented purchase dates/prices. This is critical for minimizing taxes on high-volatility assets like Dogecoin.

- DeFi and Staking: Income from decentralized finance (DeFi) protocols or staking rewards is taxable as ordinary income. If you’ve used Coinbase Wallet to interact with blockchain technology outside the exchange, you’ll need third-party tools like CoinTracker for full visibility.

- Loss Harvesting: Sold Bitcoin at a loss? You can offset gains elsewhere—up to $3,000 annually against ordinary income—but wash-sale rules don’t yet apply to crypto assets (as of 2025).

Institutional and Corporate Considerations

For Coinbase Global, Inc. (ticker: COIN) investors or institutions using Coinbase Custody, tax reporting scales with activity. The S&P 500-listed company’s stock price fluctuations may also impact your portfolio’s tax strategy. Brian Armstrong, Coinbase’s CEO, has advocated for clearer crypto tax guidelines, but until then, meticulous record-keeping is non-negotiable. Pro tip: Use Coinbase Prime’s enterprise-grade reporting APIs to streamline filings for high trading volume accounts.

State-Specific Nuances

While federal rules apply nationwide, states like California and New York have additional reporting thresholds. For example, crypto payments received as income might trigger state-level obligations even if below the IRS’s $600 threshold. Always cross-check with a tax professional familiar with blockchain transactions.

By leveraging Coinbase’s built-in tools and staying informed about evolving regulations, you can turn tax season from a headache into a strategic opportunity—whether you’re trading Solana or hodling Ethereum for the long haul.

Professional illustration about Coinbase

Coinbase Mobile App

The Coinbase Mobile App has become a powerhouse for crypto trading, offering users seamless access to Bitcoin, Ethereum, Solana, and even meme coins like Dogecoin. Designed for both beginners and seasoned traders, the app combines Coinbase Wallet integration with advanced features like crypto custody and real-time trading volume tracking. Under CEO Brian Armstrong's leadership, Coinbase Global, Inc. has continuously refined the app’s UX, making it one of the most intuitive platforms for buying and selling crypto. Whether you're checking market cap trends or executing quick trades, the app’s clean interface and robust security—backed by blockchain technology—ensure a smooth experience.

For those diving into decentralized finance (DeFi), the app supports Coinbase Prime for institutional-grade trading, while Coinbase One caters to retail users with fee-free trades and enhanced analytics. The app also simplifies crypto payments, allowing merchants and users to transact effortlessly. With Coinbase Global now part of the S&P 500, its stock (COIN) reflects growing mainstream adoption, and the mobile app is at the forefront of this shift. Features like crypto rewards for staking and educational tools help users maximize their digital assets.

What sets the Coinbase Mobile App apart is its versatility. You can track Tether (USDT) stability, explore blockchain projects, or even secure loans against your holdings—all from your smartphone. The app’s cryptocurrency exchange functionality is lightning-fast, with real-time price alerts and customizable watchlists. Plus, its integration with Coinbase Wallet means you’re never more than a tap away from managing your crypto assets on the go. For investors eyeing long-term growth, the app’s institutional tools and transparent fee structure make it a standout in the crowded crypto wallet space.

Security is another highlight. The app employs biometric logins, multi-signature crypto custody, and cold storage for large holdings. Whether you’re a casual trader or a digital assets pro, the Coinbase Mobile App delivers a balanced mix of accessibility and depth, cementing its role as a must-have tool in 2025’s cryptocurrency landscape.

Professional illustration about Coinbase

Coinbase vs Competitors

Coinbase vs Competitors: How the Leading Crypto Exchange Stacks Up in 2025

When it comes to cryptocurrency exchanges, Coinbase Global, Inc. remains a dominant player, but the competition has never been fiercer. As of 2025, platforms like Binance, Kraken, and Gemini continue to challenge Coinbase in terms of trading volume, market cap, and user experience. One of Coinbase's biggest advantages is its regulatory compliance and reputation as a publicly traded company (listed as COIN on the S&P 500), which attracts institutional investors through services like Coinbase Prime and Coinbase Custody. However, competitors often undercut Coinbase's fees, making them more appealing to high-frequency crypto traders.

Brian Armstrong, CEO of Coinbase, has doubled down on innovation to stay ahead. For example, Coinbase One, the subscription-based service launched in 2023, offers zero-fee trading and enhanced customer support—a direct response to rivals like Gemini’s premium memberships. Meanwhile, Coinbase Wallet remains a standout for decentralized finance (DeFi) enthusiasts, supporting Ethereum, Solana, and other blockchain networks. Competitors like MetaMask and Trust Wallet offer similar crypto wallet functionalities, but Coinbase integrates seamlessly with its exchange, making buying and selling crypto more convenient for beginners.

Where Coinbase truly shines is in its crypto assets diversity. While rivals may focus heavily on Bitcoin and Ethereum, Coinbase supports niche tokens like Dogecoin and stablecoins such as Tether, appealing to a broader audience. That said, Binance still leads in trading volume due to its vast altcoin offerings and lower fees. Coinbase’s answer? A stronger emphasis on crypto rewards programs and educational content to retain users.

For institutional clients, Coinbase Global Inc. has invested heavily in blockchain technology infrastructure, particularly through Coinbase Prime, which offers advanced trading tools and crypto custody solutions. Competitors like Kraken and BitGo provide comparable services, but Coinbase’s integration with traditional finance (thanks to its S&P 500 status) gives it an edge in credibility. Retail traders, on the other hand, may prefer platforms with lower costs, but Coinbase’s user-friendly interface and robust security measures keep it a top choice for newcomers.

In the realm of crypto payments, Coinbase has made strides with its Coinbase Card and merchant solutions, though competitors like PayPal and Crypto.com are aggressively expanding in this space. The exchange’s ability to balance innovation with regulatory compliance will be crucial in maintaining its lead. As the cryptocurrency market evolves, Coinbase’s challenge is clear: stay ahead on technology while keeping fees competitive—a tightrope walk that will define its position against rivals in 2025 and beyond.

Professional illustration about Cryptocurrency

Coinbase Earn Program

The Coinbase Earn Program is an innovative way for users to learn about cryptocurrency while earning digital assets like Bitcoin, Ethereum, Dogecoin, or Solana. Founded by Brian Armstrong and operated by Coinbase Global, Inc., this rewards-based initiative bridges the gap between education and passive income in the crypto trading space. Unlike traditional cryptocurrency exchanges that focus solely on buy and sell crypto transactions, Coinbase Earn encourages users to complete short educational modules—such as videos or quizzes—about emerging blockchain technology projects. In return, participants receive small amounts of crypto directly into their Coinbase Wallet or trading account, creating a seamless entry point for beginners.

As of 2025, the program supports over a dozen crypto assets, including stablecoins like Tether, and aligns with Coinbase’s broader mission to expand decentralized finance (DeFi) adoption. For example, a user might watch a 3-minute tutorial on Solana’s high-speed blockchain, answer a few questions, and earn $5 worth of SOL—a win-win for both the platform and the learner. The rewards vary based on market conditions and trading volume, but they often represent a fraction of the featured asset’s market cap. Notably, the program’s flexibility allows users to convert earnings into other supported coins or withdraw them via Coinbase Prime for institutional-grade crypto custody.

What sets Coinbase Earn apart is its integration with the company’s ecosystem. Users of Coinbase One (the subscription-based service) often receive exclusive or higher-tier rewards, while the free tier remains accessible to all. The program also complements Coinbase Global Inc.’s standing in traditional finance; as a Nasdaq-listed company (COIN) now included in the S&P 500, its initiatives like Earn reinforce mainstream crypto credibility. Critics, however, point out that rewards have diminished compared to earlier years due to regulatory scrutiny and fluctuating stock price pressures. Yet, for small-scale investors, it’s still a risk-free way to diversify into crypto payments or long-term holdings.

Pro tips for maximizing Coinbase Earn:

- Check the app weekly—new campaigns drop frequently, especially for altcoins.

- Combine with staking—some earned assets, like Ethereum, can be staked for additional crypto rewards.

- Verify your account early—KYC delays can cause missed opportunities during high-demand promotions.

- Track tax implications—rewards are taxable as income in most jurisdictions, so use Coinbase Wallet’s reporting tools.

The program’s future may hinge on Coinbase’s ability to balance user growth with profitability. As competition grows in crypto custody and education, expect tighter reward structures but potentially more partnerships with blockchain projects. For now, it remains one of the most beginner-friendly on-ramps into the volatile yet lucrative world of digital assets.

Professional illustration about Solana

Coinbase Customer Support

Coinbase Customer Support has evolved significantly in 2025 to meet the growing demands of its 100M+ users, blending AI-driven tools with human expertise to resolve issues ranging from Bitcoin transfers to Ethereum staking queries. Under Brian Armstrong’s leadership, Coinbase Global, Inc. has prioritized a tiered support system: free assistance for basic account issues (like password resets) and premium 24/7 access for Coinbase One subscribers, which includes faster response times for crypto trading disputes or crypto custody concerns. For institutional clients, Coinbase Prime offers dedicated account managers—a nod to the platform’s expansion into decentralized finance (DeFi) and blockchain technology services.

One standout feature is the Coinbase Wallet integration with support channels. Users can now troubleshoot Solana token swaps or Dogecoin transaction delays directly within the app via live chat, reducing reliance on email tickets. The system also flags recurring issues—like Tether deposit delays during high trading volume periods—and proactively notifies affected users. Data shows this reduced complaint volumes by 30% in early 2025, a win for both customers and COIN’s stock price, which remains sensitive to user sentiment amid S&P 500 volatility.

However, challenges persist. Critics note that cryptocurrency exchange support still lags behind traditional finance in resolving complex blockchain disputes (e.g., smart contract failures). Coinbase counters this with its Crypto Assets Recovery Team, launched last year to handle edge cases like lost private keys—though eligibility depends on factors like market cap thresholds for the involved tokens. For everyday users, the Help Center remains a goldmine, with step-by-step guides on topics from buy and sell crypto limits to crypto rewards tax reporting. Pro tip: Clear your browser cache before submitting a ticket; outdated cookies cause 20% of falsely flagged login issues.

The platform’s transparency dashboard (updated quarterly) reveals metrics like average resolution time (currently 14 hours for non-urgent cases) and crypto payments dispute rates. This accountability aligns with Coinbase Global’s push to standardize support across its ecosystem—a necessity as regulatory scrutiny intensifies. Whether you’re a digital assets newbie or a high-volume trader, documenting your issue with screenshots and transaction IDs (e.g., TX hash for Ethereum network errors) dramatically speeds up resolutions. For institutional clients, Coinbase Prime’s SLA guarantees 4-hour responses—critical when dealing with seven-figure crypto custody transfers.

Professional illustration about Tether

Coinbase Future Trends

Coinbase Future Trends

As we move further into 2025, Coinbase Global, Inc. (NASDAQ: COIN) continues to solidify its position as a leading cryptocurrency exchange, but its future hinges on several key trends shaping the digital assets landscape. Under CEO Brian Armstrong, the company is aggressively expanding beyond just buy and sell crypto services, focusing on decentralized finance (DeFi), institutional adoption, and regulatory compliance. One major trend is the growing institutional demand for crypto custody solutions, where Coinbase Prime is gaining traction among hedge funds and asset managers. The platform’s seamless integration with blockchain technology and secure storage for Bitcoin, Ethereum, and Solana makes it a preferred choice for high-net-worth investors.

Another critical area is Coinbase Wallet, which is evolving beyond a simple crypto wallet into a gateway for DeFi applications. With Dogecoin and Tether gaining mainstream acceptance, the wallet’s ability to support multiple crypto assets positions it as a versatile tool for retail and professional traders alike. Coinbase One, the subscription-based service, is also gaining momentum by offering zero-fee crypto trading and enhanced customer support—a move that could disrupt traditional brokerage models.

The company’s stock (COIN) has shown resilience despite cryptocurrency market volatility, even outperforming the S&P 500 in certain quarters. Analysts attribute this to Coinbase Global's diversified revenue streams, including crypto payments and crypto rewards programs. For instance, its partnerships with payment processors have enabled seamless crypto-to-fiat conversions, appealing to merchants and consumers.

Looking ahead, Coinbase faces both opportunities and challenges. Regulatory clarity will play a pivotal role, especially as governments worldwide refine policies around blockchain and digital assets. The platform’s ability to innovate—whether through Coinbase Prime for institutions or Coinbase One for retail users—will determine its long-term success. With trading volume and market cap for major cryptos like Bitcoin and Ethereum reaching new heights, Coinbase is well-positioned to capitalize on the next wave of crypto adoption. However, competition from decentralized exchanges (DEXs) and fintech giants means the company must continuously enhance its offerings to stay ahead.

For investors and traders, monitoring Coinbase Global Inc.'s adaptation to these trends is crucial. Whether it’s leveraging Solana’s fast transactions or integrating Tether for stablecoin liquidity, the exchange’s agility in responding to market shifts will be a key indicator of its future growth. As Brian Armstrong often emphasizes, the goal isn’t just to be a cryptocurrency exchange—it’s to build the infrastructure for the entire digital assets economy.